Page 187 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 187

• 185

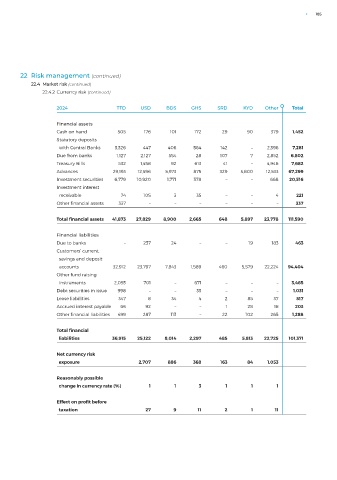

22 Risk management (continued)

22.4 Market risk (continued)

22.4.2 Currency risk (continued)

2024 TTD USD BDS GHS SRD KYD Other Total

Financial assets

Cash on hand 505 176 101 172 29 90 379 1,452

Statutory deposits

with Central Banks 3,326 447 406 564 142 – 2,396 7,281

Due from banks 1,127 2,127 554 28 107 7 2,852 6,802

Treasury Bills 532 1,458 92 613 41 – 4,946 7,682

Advances 29,193 12,596 5,973 875 329 5,800 12,533 67,299

Investment securities 6,779 10,920 1,771 378 – – 668 20,516

Investment interest

receivable 74 105 3 35 – – 4 221

Other financial assets 337 – – – – – – 337

Total financial assets 41,873 27,829 8,900 2,665 648 5,897 23,778 111,590

Financial liabilities

Due to banks – 237 24 – – 19 183 463

Customers’ current,

savings and deposit

accounts 32,912 23,797 7,843 1,589 460 5,579 22,224 94,404

Other fund raising

instruments 2,093 701 – 671 – – – 3,465

Debt securities in issue 998 – – 33 – – – 1,031

Lease liabilities 347 8 34 4 2 85 37 517

Accrued interest payable 66 92 – – 1 28 16 203

Other financial liabilities 499 287 113 – 22 102 265 1,288

Total financial

liabilities 36,915 25,122 8,014 2,297 485 5,813 22,725 101,371

Net currency risk

exposure 2,707 886 368 163 84 1,053

Reasonably possible

change in currency rate (%) 1 1 3 1 1 1

Effect on profit before

taxation 27 9 11 2 1 11