Page 192 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 192

190 • Republic Financial Holdings Limited 2025 Annual Report • FINANCIALS

Notes to the Consolidated Financial Statements

For the year ended September 30, 2025. Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

25 Fair value (continued)

25.2 Fair value and fair value hierarchies (continued)

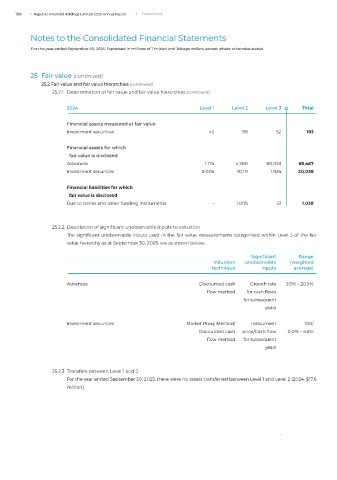

25.2.1 Determination of fair value and fair value hierarchies (continued)

2024 Level 1 Level 2 Level 3 Total

Financial assets measured at fair value

Investment securities 42 99 52 193

Financial assets for which

fair value is disclosed

Advances 1,174 4,260 60,053 65,487

Investment securities 8,004 10,111 1,924 20,039

Financial liabilities for which

fair value is disclosed

Due to banks and other funding instruments – 1,005 33 1,038

25.2.2 Description of significant unobservable inputs to valuation

The significant unobservable inputs used in the fair value measurements categorised within Level 3 of the fair

value hierarchy as at September 30, 2025, are as shown below:

Significant Range

Valuation unobservable (weighted

technique inputs average)

Advances Discounted cash Growth rate 3.5% – 20.5%

flow method for cash flows

for subsequent

years

Investment securities Market Proxy Method/ Instrument 100/

Discounted cash price/Cash flow 0.0% – 4.5%

flow method for subsequent

years

25.2.3 Transfers between Level 1 and 2

For the year ended September 30, 2025, there were no assets transferred between Level 1 and Level 2 (2024: $17.6

million).

-