Page 190 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 190

188 • Republic Financial Holdings Limited 2025 Annual Report • FINANCIALS

Notes to the Consolidated Financial Statements

For the year ended September 30, 2025. Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

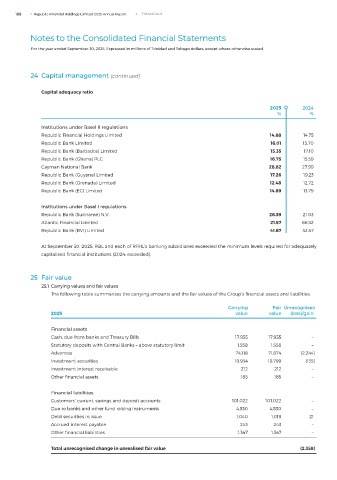

24 Capital management (continued)

Capital adequacy ratio

2025 2024

% %

Institutions under Basel II regulations

Republic Financial Holdings Limited 14.88 14.75

Republic Bank Limited 16.01 15.70

Republic Bank (Barbados) Limited 15.35 17.10

Republic Bank (Ghana) PLC 16.75 15.59

Cayman National Bank 28.82 27.99

Republic Bank (Guyana) Limited 17.26 19.23

Republic Bank (Grenada) Limited 12.48 12.72

Republic Bank (EC) Limited 14.89 13.79

Institutions under Basel I regulations

Republic Bank (Suriname) N.V. 26.39 21.03

Atlantic Financial Limited 21.57 66.52

Republic Bank (BVI) Limited 41.67 32.47

At September 30, 2025, RBL and each of RFHL’s banking subsidiaries exceeded the minimum levels required for adequately

capitalised financial institutions (2024: exceeded).

25 Fair value

25.1 Carrying values and fair values

The following table summarises the carrying amounts and the fair values of the Group’s financial assets and liabilities:

Carrying Fair Unrecognised

2025 value value (loss)/gain

Financial assets

Cash, due from banks and Treasury Bills 17,935 17,935 –

Statutory deposits with Central Banks – above statutory limit 1,558 1,558 –

Advances 74,118 71,874 (2,244)

Investment securities 19,934 19,799 (135)

Investment interest receivable 212 212 –

Other financial assets 185 185 –

Financial liabilities

Customers’ current, savings and deposit accounts 101,022 101,022 –

Due to banks and other fund raising instruments 4,530 4,530 –

Debt securities in issue 1,040 1,019 21

Accrued interest payable 243 243 –

Other financial liabilities 1,347 1,347 –

Total unrecognised change in unrealised fair value (2,358)