Page 186 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 186

184 • Republic Financial Holdings Limited 2025 Annual Report • FINANCIALS

Notes to the Consolidated Financial Statements

For the year ended September 30, 2025. Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

22 Risk management (continued)

22.4 Market risk (continued)

22.4.2 Currency risk (continued)

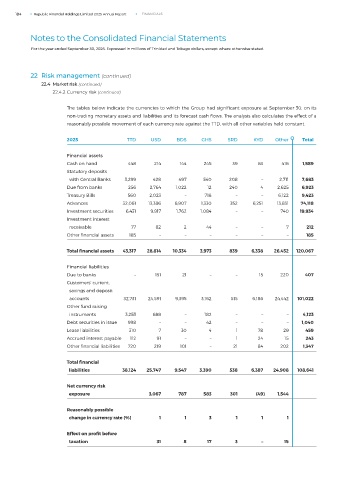

The tables below indicate the currencies to which the Group had significant exposure at September 30, on its

non-trading monetary assets and liabilities and its forecast cash flows. The analysis also calculates the effect of a

reasonably possible movement of each currency rate against the TTD, with all other variables held constant.

2025 TTD USD BDS GHS SRD KYD Other Total

Financial assets

Cash on hand 448 214 144 245 39 83 416 1,589

Statutory deposits

with Central Banks 3,299 428 497 540 208 – 2,711 7,683

Due from banks 256 2,764 1,022 12 240 4 2,625 6,923

Treasury Bills 560 2,023 – 718 – – 6,122 9,423

Advances 32,061 13,386 6,907 1,330 352 6,251 13,831 74,118

Investment securities 6,431 9,917 1,762 1,084 – – 740 19,934

Investment interest

receivable 77 82 2 44 – – 7 212

Other financial assets 185 – – – – – – 185

Total financial assets 43,317 28,814 10,334 3,973 839 6,338 26,452 120,067

Financial liabilities

Due to banks – 151 21 – – 15 220 407

Customers’ current,

savings and deposit

accounts 32,731 24,591 9,395 3,162 515 6,186 24,442 101,022

Other fund raising

instruments 3,253 688 – 182 – – – 4,123

Debt securities in issue 998 – – 42 – – – 1,040

Lease liabilities 310 7 30 4 1 78 29 459

Accrued interest payable 112 91 – – 1 24 15 243

Other financial liabilities 720 219 101 – 21 84 202 1,347

Total financial

liabilities 38,124 25,747 9,547 3,390 538 6,387 24,908 108,641

Net currency risk

exposure 3,067 787 583 301 (49) 1,544

Reasonably possible

change in currency rate (%) 1 1 3 1 1 1

Effect on profit before

taxation 31 8 17 3 – 15