Page 184 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 184

182 • Republic Financial Holdings Limited 2025 Annual Report • FINANCIALS

Notes to the Consolidated Financial Statements

For the year ended September 30, 2025. Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

22 Risk management (continued)

22.3 Liquidity risk (continued)

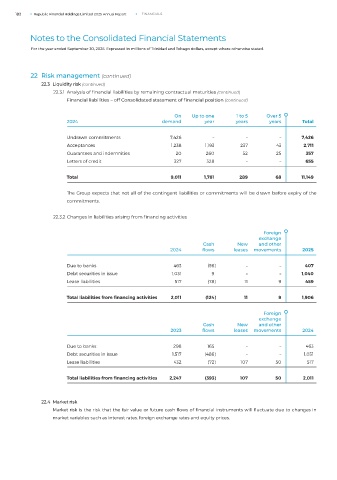

22.3.1 Analysis of financial liabilities by remaining contractual maturities (continued)

Financial liabilities – off Consolidated statement of financial position (continued)

On Up to one 1 to 5 Over 5

2024 demand year years years Total

Undrawn commitments 7,426 – – – 7,426

Acceptances 1,238 1,193 237 43 2,711

Guarantees and indemnities 20 260 52 25 357

Letters of credit 327 328 – – 655

Total 9,011 1,781 289 68 11,149

The Group expects that not all of the contingent liabilities or commitments will be drawn before expiry of the

commitments.

22.3.2 Changes in liabilities arising from financing activities

Foreign

exchange

Cash New and other

2024 flows leases movements 2025

Due to banks 463 (56) – – 407

Debt securities in issue 1,031 9 – – 1,040

Lease liabilities 517 (78) 11 9 459

Total liabilities from financing activities 2,011 (124) 11 9 1,906

Foreign

exchange

Cash New and other

2023 flows leases movements 2024

Due to banks 298 165 – – 463

Debt securities in issue 1,517 (486) – – 1,031

Lease liabilities 432 (72) 107 50 517

Total liabilities from financing activities 2,247 (393) 107 50 2,011

22.4 Market risk

Market risk is the risk that the fair value or future cash flows of financial instruments will fluctuate due to changes in

market variables such as interest rates, foreign exchange rates and equity prices.