Page 179 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 179

• 177

22 Risk management (continued)

22.2 Credit risk (continued)

22.2.6 Grouping financial assets measured on a collective or individual basis (continued)

Asset classes where the Group calculates ECL on an individual basis include:

• All Stage 3 assets, regardless of the class of financial assets

• The commercial and corporate lending and overdraft portfolio

• The mortgage portfolio

• The retail lending portfolio

• The credit card portfolio

Asset classes where the Group calculates ECL on a collective basis include:

• The retail overdraft portfolio

• Subsidiaries with small, homogeneous retail portfolios

• Past due not yet relegated credit facilities

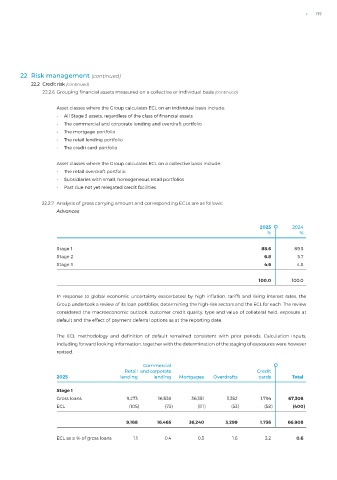

22.2.7 Analysis of gross carrying amount and corresponding ECLs are as follows:

Advances

2025 2024

% %

Stage 1 88.6 89.5

Stage 2 6.8 5.7

Stage 3 4.6 4.8

100.0 100.0

In response to global economic uncertainty exacerbated by high inflation, tariffs and rising interest rates, the

Group undertook a review of its loan portfolios, determining the high-risk sectors and the ECL for each. The review

considered the macroeconomic outlook, customer credit quality, type and value of collateral held, exposure at

default and the effect of payment deferral options as at the reporting date.

The ECL methodology and definition of default remained consistent with prior periods. Calculation inputs,

including forward looking information, together with the determination of the staging of exposures were however

revised.

Commercial

Retail and corporate Credit

2025 lending lending Mortgages Overdrafts cards Total

Stage 1

Gross loans 9,273 16,538 36,351 3,352 1,794 67,308

ECL (105) (73) (111) (53) (58) (400)

9,168 16,465 36,240 3,299 1,736 66,908

ECL as a % of gross loans 1.1 0.4 0.3 1.6 3.2 0.6