Page 181 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 181

• 179

22 Risk management (continued)

22.2 Credit risk (continued)

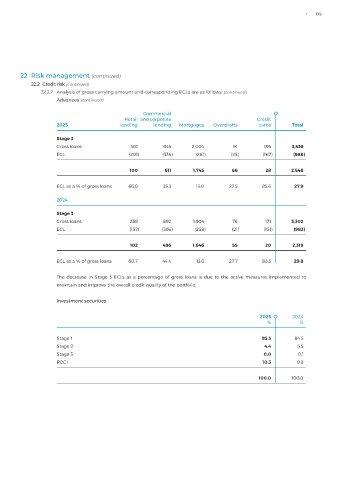

22.2.7 Analysis of gross carrying amount and corresponding ECLs are as follows: (continued)

Advances (continued)

Commercial

Retail and corporate Credit

2025 lending lending Mortgages Overdrafts cards Total

Stage 3

Gross loans 301 945 2,004 91 195 3,536

ECL (201) (334) (261) (25) (167) (988)

100 611 1,745 66 28 2,548

ECL as a % of gross loans 66.8 35.3 13.0 27.5 85.6 27.9

2024

Stage 3

Gross loans 259 892 1,904 76 171 3,302

ECL (157) (396) (258) (21) (151) (983)

102 496 1,646 55 20 2,319

ECL as a % of gross loans 60.7 44.4 13.6 27.7 88.3 29.8

The decrease in Stage 3 ECLs as a percentage of gross loans is due to the active measures implemented to

maintain and improve the overall credit quality of the portfolio.

Investment securities

2025 2024

% %

Stage 1 85.3 84.5

Stage 2 4.4 5.5

Stage 3 0.0 0.1

POCI 10.3 9.9

100.0 100.0