Page 197 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 197

• 195

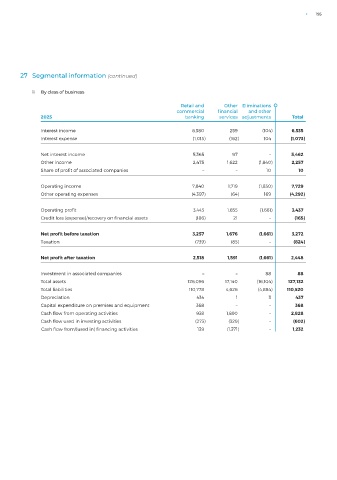

27 Segmental information (continued)

ii By class of business

Retail and Other Eliminations

commercial financial and other

2025 banking services adjustments Total

Interest income 6,380 259 (104) 6,535

Interest expense (1,015) (162) 104 (1,073)

Net interest income 5,365 97 – 5,462

Other income 2,475 1,622 (1,840) 2,257

Share of profit of associated companies – – 10 10

Operating income 7,840 1,719 (1,830) 7,729

Other operating expenses (4,397) (64) 169 (4,292)

Operating profit 3,443 1,655 (1,661) 3,437

Credit loss (expense)/recovery on financial assets (186) 21 – (165)

Net profit before taxation 3,257 1,676 (1,661) 3,272

Taxation (739) (85) – (824)

Net profit after taxation 2,518 1,591 (1,661) 2,448

Investment in associated companies – – 88 88

Total assets 126,096 17,140 (16,104) 127,132

Total liabilities 110,778 4,626 (4,884) 110,520

Depreciation 434 1 3 437

Capital expenditure on premises and equipment 368 – – 368

Cash flow from operating activities 938 1,890 – 2,828

Cash flow used in investing activities (273) (329) – (602)

Cash flow from/(used in) financing activities 139 (1,371) – 1,232