Page 202 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 202

200 • Republic Financial Holdings Limited 2025 Annual Report • FINANCIALS

Notes to the Consolidated Financial Statements

For the year ended September 30, 2025. Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

29 Equity compensation benefits (continued)

Stock option plan (continued)

The weighted average share price for share options exercised during the year was $96.24 (2024: $96.28). For options outstanding

at September 30, 2025, the exercise price ranged from $92.67 to $142.24 and the weighted average remaining contractual life

was 7.6 years.

The total expense for the share option plan was $5.1 million (2024: $4.7 million).

Profit sharing scheme

It is estimated that approximately $223 million (2024: $206 million) will be allocated to staff from the profit sharing scheme

in the current financial year as shown in Note 19 (d).

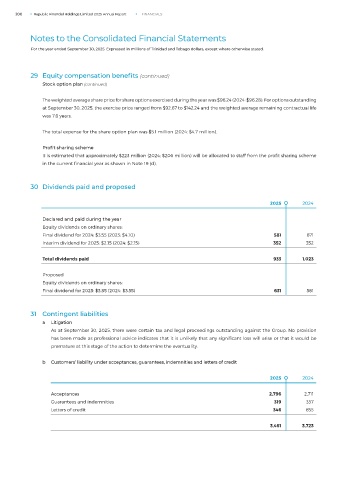

30 Dividends paid and proposed

2025 2024

Declared and paid during the year

Equity dividends on ordinary shares:

Final dividend for 2024: $3.55 (2023: $4.10) 581 671

Interim dividend for 2025: $2.15 (2024: $2.15) 352 352

Total dividends paid 933 1,023

Proposed

Equity dividends on ordinary shares:

Final dividend for 2025: $3.85 (2024: $3.55) 631 581

31 Contingent liabilities

a Litigation

As at September 30, 2025, there were certain tax and legal proceedings outstanding against the Group. No provision

has been made as professional advice indicates that it is unlikely that any significant loss will arise or that it would be

premature at this stage of the action to determine the eventuality.

b Customers’ liability under acceptances, guarantees, indemnities and letters of credit

2025 2024

Acceptances 2,796 2,711

Guarantees and indemnities 319 357

Letters of credit 346 655

3,461 3,723