Page 201 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 201

• 199

29 Equity compensation benefits (continued)

Stock option plan (continued)

The plan provides that the maximum number of ordinary shares that may be purchased on the exercise of options is 7,950,650

shares and the maximum entitlement for any one executive is no more than 50 percent of the shares comprising the plan.

There is a three-year waiting period after the grant date of options before the grantee may exercise the right to purchase the

shares represented by the options. The maximum period within which an option may be exercised is ten years.

The option price shall be RFHL’s share price at the beginning of the performance period during which the option is earned.

The price is calculated as the average closing share price on all trading days during the calendar month, prior to the beginning

of the performance period. The process of assessment, calculation of options and approval by the Board of Directors takes

place in the first quarter following the end of the financial year.

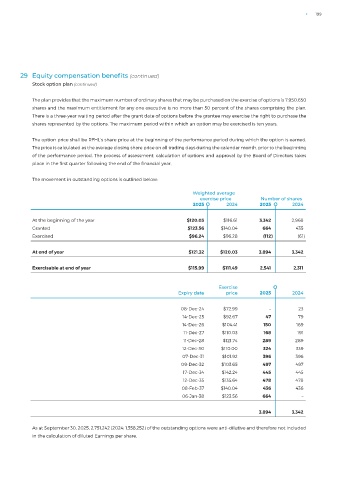

The movement in outstanding options is outlined below:

Weighted average

exercise price Number of shares

2025 2024 2025 2024

At the beginning of the year $120.03 $116.61 3,342 2,968

Granted $123.56 $140.04 664 435

Exercised $96.24 $96.28 (112) (61)

At end of year $121.32 $120.03 3,894 3,342

Exercisable at end of year $115.99 $111.49 2,541 2,311

Exercise

Expiry date price 2025 2024

08-Dec-24 $72.99 – 23

14-Dec-25 $92.67 47 79

14-Dec-26 $104.41 150 169

11-Dec-27 $110.03 168 191

11-Dec-28 $121.74 289 289

12-Dec-30 $110.00 324 339

07-Dec-31 $101.92 396 396

09-Dec-32 $103.65 497 497

17-Dec-34 $142.24 445 445

12-Dec-35 $135.64 478 478

08-Feb-37 $140.04 436 436

06-Jan-38 $123.56 664 –

3,894 3,342

As at September 30, 2025, 2,751,242 (2024: 1,358,252) of the outstanding options were anti-dilutive and therefore not included

in the calculation of diluted Earnings per share.