Page 199 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 199

• 197

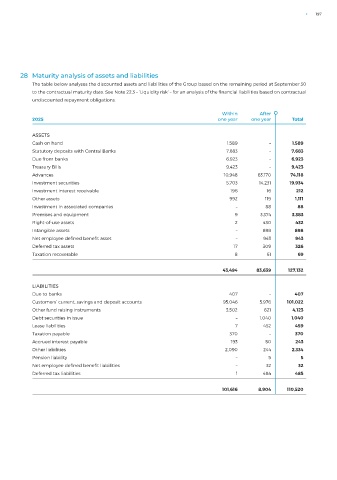

28 Maturity analysis of assets and liabilities

The table below analyses the discounted assets and liabilities of the Group based on the remaining period at September 30

to the contractual maturity date. See Note 22.3 – ‘Liquidity risk’ – for an analysis of the financial liabilities based on contractual

undiscounted repayment obligations.

Within After

2025 one year one year Total

ASSETS

Cash on hand 1,589 – 1,589

Statutory deposits with Central Banks 7,683 – 7,683

Due from banks 6,923 – 6,923

Treasury Bills 9,423 – 9,423

Advances 10,948 63,170 74,118

Investment securities 5,703 14,231 19,934

Investment interest receivable 196 16 212

Other assets 992 119 1,111

Investment in associated companies – 88 88

Premises and equipment 9 3,374 3,383

Right-of-use assets 2 430 432

Intangible assets – 898 898

Net employee defined benefit asset – 943 943

Deferred tax assets 17 309 326

Taxation recoverable 8 61 69

43,494 83,639 127,132

LIABILITIES

Due to banks 407 – 407

Customers’ current, savings and deposit accounts 95,046 5,976 101,022

Other fund raising instruments 3,502 621 4,123

Debt securities in issue – 1,040 1,040

Lease liabilities 7 452 459

Taxation payable 370 – 370

Accrued interest payable 193 50 243

Other liabilities 2,090 244 2,334

Pension liability – 5 5

Net employee defined benefit liabilities – 32 32

Deferred tax liabilities 1 484 485

101,616 8,904 110,520