Page 203 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 203

• 201

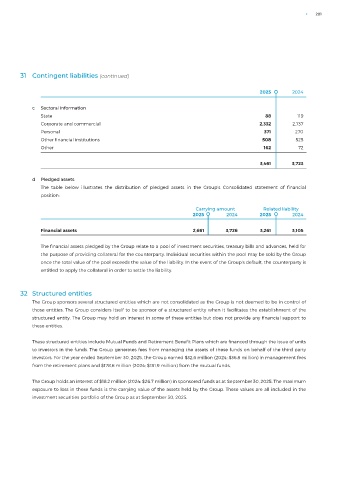

31 Contingent liabilities (continued)

2025 2024

c Sectoral information

State 88 119

Corporate and commercial 2,332 2,737

Personal 371 270

Other financial institutions 508 525

Other 162 72

3,461 3,723

d Pledged assets

The table below illustrates the distribution of pledged assets in the Group’s Consolidated statement of financial

position:

Carrying amount Related liability

2025 2024 2025 2024

Financial assets 2,661 3,726 3,261 3,105

The financial assets pledged by the Group relate to a pool of investment securities, treasury bills and advances, held for

the purpose of providing collateral for the counterparty. Individual securities within the pool may be sold by the Group

once the total value of the pool exceeds the value of the liability. In the event of the Group’s default, the counterparty is

entitled to apply the collateral in order to settle the liability.

32 Structured entities

The Group sponsors several structured entities which are not consolidated as the Group is not deemed to be in control of

those entities. The Group considers itself to be sponsor of a structured entity when it facilitates the establishment of the

structured entity. The Group may hold an interest in some of these entities but does not provide any financial support to

these entities.

These structured entities include Mutual Funds and Retirement Benefit Plans which are financed through the issue of units

to investors in the funds. The Group generates fees from managing the assets of these funds on behalf of the third party

investors. For the year ended September 30, 2025, the Group earned $32.6 million (2024: $36.8 million) in management fees

from the retirement plans and $178.6 million (2024: $181.9 million) from the mutual funds.

The Group holds an interest of $18.2 million (2024: $26.7 million) in sponsored funds as at September 30, 2025. The maximum

exposure to loss in these funds is the carrying value of the assets held by the Group. These values are all included in the

investment securities portfolio of the Group as at September 30, 2025.