Page 204 - RFHL ANNUAL REPORT 2025 ONLINE_NEW

P. 204

202 • Republic Financial Holdings Limited 2025 Annual Report • FINANCIALS

Notes to the Consolidated Financial Statements

For the year ended September 30, 2025. Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

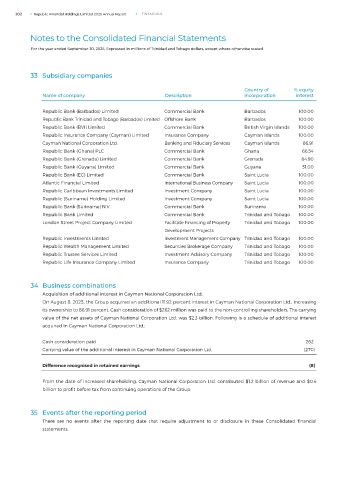

33 Subsidiary companies

Country of % equity

Name of company Description incorporation interest

Republic Bank (Barbados) Limited Commercial Bank Barbados 100.00

Republic Bank Trinidad and Tobago (Barbados) Limited Offshore Bank Barbados 100.00

Republic Bank (BVI) Limited Commercial Bank British Virgin Islands 100.00

Republic Insurance Company (Cayman) Limited Insurance Company Cayman Islands 100.00

Cayman National Corporation Ltd. Banking and Fiduciary Services Cayman Islands 86.91

Republic Bank (Ghana) PLC Commercial Bank Ghana 66.54

Republic Bank (Grenada) Limited Commercial Bank Grenada 84.90

Republic Bank (Guyana) Limited Commercial Bank Guyana 51.00

Republic Bank (EC) Limited Commercial Bank Saint Lucia 100.00

Atlantic Financial Limited International Business Company Saint Lucia 100.00

Republic Caribbean Investments Limited Investment Company Saint Lucia 100.00

Republic (Suriname) Holding Limited Investment Company Saint Lucia 100.00

Republic Bank (Suriname) N.V. Commercial Bank Suriname 100.00

Republic Bank Limited Commercial Bank Trinidad and Tobago 100.00

London Street Project Company Limited Facilitate Financing of Property Trinidad and Tobago 100.00

Development Projects

Republic Investments Limited Investment Management Company Trinidad and Tobago 100.00

Republic Wealth Management Limited Securities Brokerage Company Trinidad and Tobago 100.00

Republic Trustee Services Limited Investment Advisory Company Trinidad and Tobago 100.00

Republic Life Insurance Company Limited Insurance Company Trinidad and Tobago 100.00

34 Business combinations

Acquisition of additional interest in Cayman National Corporation Ltd.

On August 8, 2025, the Group acquired an additional 11.92 percent interest in Cayman National Corporation Ltd., increasing

its ownership to 86.91 percent. Cash consideration of $262 million was paid to the non-controlling shareholders. The carrying

value of the net assets of Cayman National Corporation Ltd. was $2.3 billion. Following is a schedule of additional interest

acquired in Cayman National Corporation Ltd.:

Cash consideration paid 262

Carrying value of the additional interest in Cayman National Corporation Ltd. (270)

Difference recognised in retained earnings (8)

From the date of increased shareholding, Cayman National Corporation Ltd. contributed $1.2 billion of revenue and $0.4

billion to profit before tax from continuing operations of the Group.

35 Events after the reporting period

There are no events after the reporting date that require adjustment to or disclosure in these Consolidated financial

statements.