Page 23 - CNB Bank Shares 2018 Annual Report

P. 23

CNB BANK SHARES, INC. AND SUBSIDIARIES CNB BANK SHARES, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements Notes to Consolidated Financial Statements

mortgage servicing rights at December 31, 2018 and 2017, respectively, are less than the amount for which and investments in available-for-sale debt and equity securities. No other assets and liabilities are recorded

such servicing rights could be sold. at fair value on a recurring or nonrecurring basis. The Bank-owned life insurance policies are valued at their

cash surrender value using Level 1 valuation inputs. The Company’s available-for-sale debt and equity

Financial Instruments securities are measured at fair value using Level 2 valuation inputs. For the securities valued using Level 2

For purposes of information included in note 15 regarding disclosures about financial instruments, financial inputs, the market valuation utilizes several sources which include observable inputs rather than “significant

instruments are defined as cash, evidence of an ownership interest in an entity, or a contract that both unobservable inputs” and, therefore, fall into the Level 2 category, and are based on dealer quotes, market

(a) imposes on one entity a contractual obligation to deliver cash or another financial instrument to a second spreads, the U.S. Treasury yield curve, trade execution data, market consensus, prepayment speeds, credit

entity or to exchange other financial instruments on potentially unfavorable terms with the second entity, and information, and the bonds’ terms and conditions at the security level.

(b) conveys to that second entity a contractual right to receive cash or another financial instrument from the

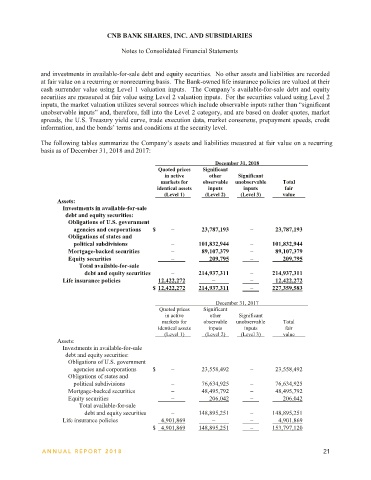

first entity or to exchange other financial instruments on potentially favorable terms with the first entity. The following tables summarize the Company’s assets and liabilities measured at fair value on a recurring

basis as of December 31, 2018 and 2017:

Stock Options

December 31, 2018

Compensation costs relating to share-based payment transactions are recognized in the Company’s Quoted prices Significant

consolidated financial statements over the period of service to which such compensation relates (generally in active other Significant

the vesting period), and are measured based on the fair value of the equity or liability instruments issued. The markets for observable unobservable Total

grant date values of employee share options are estimated using option-pricing models adjusted for the unique identical assets inputs inputs fair

characteristics of those instruments. If an equity award is modified after the grant date, incremental (Level 1) (Level 2) (Level 3) value

compensation cost would be recognized in an amount equal to the excess of the fair value of the modified Assets:

award over the fair value of the original award immediately before the modification. Investments in available-for-sale

debt and equity securities:

Obligations of U.S. government

Fair Value Measurements agencies and corporations $ − 23,787,193 − 23,787,193

The Company uses fair value measurements to determine fair value disclosures. Fair value is the price that Obligations of states and

would be received to sell an asset or paid to transfer a liability in an orderly transaction between market political subdivisions − 101,832,944 − 101,832,944

participants at the measurement date. In determining fair value, the Company uses various methods, including Mortgage-backed securities − 89,107,379 − 89,107,379

market, income, and cost approaches. Based on these approaches, the Company often utilizes certain Equity securities − 209,795 − 209,795

assumptions that market participants would use in pricing the asset or liability, including assumptions about Total available-for-sale

risk and/or the risks inherent in the inputs to the valuation technique. These inputs can be readily observable, debt and equity securities − 214,937,311 − 214,937,311

market corroborated, or generally unobservable inputs. The Company utilizes valuation techniques that Life insurance policies 12,422,272 − − 12,422,272

maximize the use of observable inputs and minimize the use of unobservable inputs. Based on the $ 12,422,272 214,937,311 − 227,359,583

observability of the inputs used in the valuation techniques, the Company is required to provide the following

information according to the fair value hierarchy. Financial assets and liabilities carried or reported at fair December 31, 2017

value will be classified and disclosed in one of the following three categories: Quoted prices Significant

in active

Significant

other

markets for observable unobservable Total

▪ Level 1 – Valuations for assets and liabilities traded in active exchange markets, such as the New York identical assets inputs inputs fair

Stock Exchange. Level 1 also includes U.S. Treasury and federal agency securities and federal agency (Level 1) (Level 2) (Level 3) value

mortgage-backed securities, which are traded by dealers or brokers in active markets. Valuations are Assets:

obtained from readily available pricing sources for market transactions involving identical assets or Investments in available-for-sale

liabilities. debt and equity securities:

Obligations of U.S. government

▪ Level 2 – Valuations for assets and liabilities traded in less active dealer or broker markets. Valuations agencies and corporations $ − 23,558,492 − 23,558,492

are obtained from third-party pricing services for identical or similar assets or liabilities. Obligations of states and

political subdivisions − 76,634,925 − 76,634,925

▪ Level 3 – Valuations for assets and liabilities that are derived from other valuation methodologies, Mortgage-backed securities − 48,495,792 − 48,495,792

including option pricing models, discounted cash flow models and similar techniques, and not based on Equity securities − 206,042 − 206,042

market exchange, dealer, or value assigned to such assets or liabilities. Total available-for-sale

debt and equity securities − 148,895,251 − 148,895,251

While certain assets and liabilities may be recorded at the lower of cost or fair value as described above on a Life insurance policies 4,901,869 − − 4,901,869

nonrecurring basis (e.g., impaired loans, loans held for sale, other real estate owned), the only assets or $ 4,901,869 148,895,251 − 153,797,120

liabilities recorded at fair value on a recurring basis are the Company’s Bank-owned life insurance policies

20 ANNUAL REPOR T 2018 ANNUAL REPOR T 2018 21