Page 48 - How To Buy A Home In Louisville

P. 48

502-812-1969 / info@rivervalleygroup .com / RiverValleyGroup.com / Keller Williams Louisville East

Property Taxes

How are property taxes calculated and when are they paid?

Your tax bill is mailed to your house at the end of each year. If your lender did not

require you to escrow for taxes, you will need to pay this amount in full. If your

mortgage loan payment includes taxes in your monthly bill, your lender will pay

the tax bill for you. Follow up on this to make sure it is done. The government will

put a lien on your house if you do not pay your property taxes.

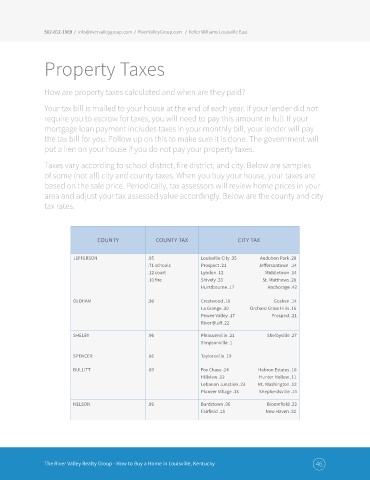

Taxes vary according to school district, fire district, and city. Below are samples

of some (not all) city and county taxes. When you buy your house, your taxes are

based on the sale price. Periodically, tax assessors will review home prices in your

area and adjust your tax assessed value accordingly. Below are the county and city

tax rates.

COUNTY COUNTY TAX CITY TAX

JEFFERSON .95 Louisville City .35 Audubon Park .28

.71 schools Prospect .21 Jeffersontown .14

.12 court Lyndon .12 Middletown .14

.10 fire Shively .33 St. Matthews .20

Hurstbourne .17 Anchorage .42

OLDHAM .98 Crestwood .10 Goshen .14

La Grange .30 Orchard Grass Hills .16

Pewee Valley .17 Prospect .21

River Bluff .22

SHELBY .96 Pleasureville .21 Shelbyville .27

Simpsonville .1

SPENCER .86 Taylorsville .19

BULLITT .89 Fox Chase .24 Hebron Estates .10

Hillview .12 Hunter Hollow .11

Lebanon Junction .23 Mt. Washington .12

Pioneer Village .13 Shepherdsville .14

NELSON .99 Bardstown .96 Bloomfield .33

Fairfield .15 New Haven .32

The River Valley Realty Group - How to Buy a Home in Louisville, Kentucky 46