Page 28 - TTMA 75th Annual Convention Bulletin

P. 28

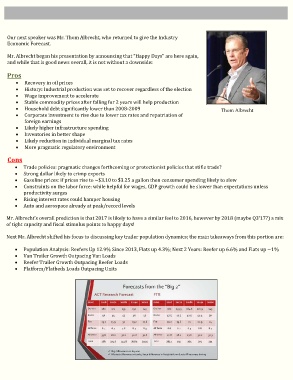

Our next speaker was Mr. Thom Albrecht, who returned to give the Industry

Economic Forecast.

Mr. Albrecht began his presentation by announcing that “Happ y Days” are here again,

and while that is good news overall, it is not without a downside:

Pros

• Recovery in oil prices

• History: Industrial production was set to recover regardless of the election

• Wage improvement to accelerate

• Stable commodity prices after falling for 2 years will help production

• Household debt significantly lower than 2008-2009 Thom Albrecht

• Corporate investment to rise due to lower tax rates and repatriation of

foreign earnings

• Likely higher infrastructure spending

• Inventories in better shape

• Likely reduction in individual marginal tax rates

• More pragmatic regulatory environment

Cons

• Trade policies: pragmatic changes forthcoming or protectionist policies that stifle trade?

• Strong dollar likely to crimp exports

• Gasoline prices: if prices rise to ~$3.10 to $3.25 a gallon then consumer spending likely to slow

• Constraints on the labor force: while helpful for wages, GDP growth could be slower than expectations unless

productivity surges

• Rising interest rates could hamper housing

• Auto and aerospace already at peak/record levels

Mr. Albrecht’s overall prediction is that 2017 is likely to have a similar feel to 2016, however by 2018 (maybe Q3’17?) a mix

of tight capacity and fiscal stimulus points to happy days!

Next Mr. Albrecht shifted his focus to discussing key trailer population dynamics; the main takeaways from this portion are:

• Population Analysis: Reefers Up 12.9% Since 2013, Flats up 4.3%; Next 2 Years: Reefer up 6.6% and Flats up ~1%

• Van Trailer Growth Outpacing Van Loads

• Reefer Trailer Growth Outpacing Reefer Loads

• Platform/Flatbeds Loads Outpacing Units