Page 4 - Q1 GI/J&J Newsletter, 2019

P. 4

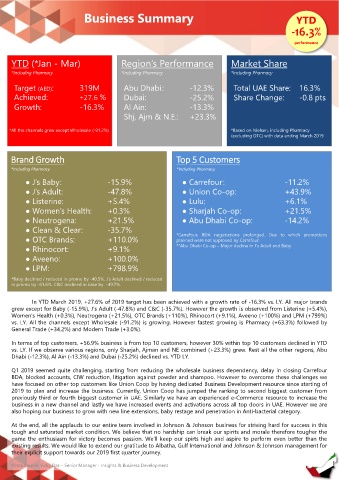

Business Summary YTD

-16.3%

performance

YTD (*Jan - Mar) Region’s Performance Market Share

*Including Pharmacy *Including Pharmacy *Including Pharmacy

Target (AED): 319M Abu Dhabi : -12.3% Total UAE Share: 16.3%

Achieved: +27.6 % Dubai: -25.2% Share Change: -0.8 pts

Growth: -16.3% Al Ain: -13.3%

Shj, Ajm & N.E.: +23.3%

*All the channels grew except Wholesale (-91.2%) *Based on Nielsen, including Pharmacy

(excluding OTC) with data ending March 2019

Brand Growth Top 5 Customers

*Including Pharmacy *Including Pharmacy

● J’s Baby: -15.9% ● Carrefour : -11.2%

● J’s Adult: -47.8% ● Union Co-op: +43.9%

● Listerine: +5.4% ● Lulu: +6.1%

● Women’s Health: +0.3% ● Sharjah Co-op: +21.5%

● Neutrogena: +21.5% ● Abu Dhabi Co-op: -14.2%

● Clean & Clear: -35.7%

● OTC Brands: +110.0% *Carrefour, BDA negotiations prolonged. Due to which promotions

planned were not approved by Carrefour.

● Rhinocort: +9.1% **Abu Dhabi Co-op – Major decline in J’s Adult and Baby

● Aveeno: +100.0%

● LPM: +798.9%

*Baby declined / reduced in promo by -40.5%. J’s Adult declined / reduced

in promo by -61.6%. C&C declined in base by -49.7%.

In YTD March 2019, +27.6% of 2019 target has been achieved with a growth rate of -16.3% vs. LY. All major brands

grew except for Baby (-15.9%), J’s Adult (-47.8%) and C&C (-35.7%). However the growth is observed from Listerine (+5.4%),

Women’s Health (+0.3%), Neutrogena (+21.5%), OTC Brands (+110%), Rhinocort (+9.1%), Aveeno (+100%) and LPM (+799%)

vs. LY. All the channels except Wholesale (-91.2%) is growing. However fastest growing is Pharmacy (+63.3%) followed by

General Trade (+34.2%) and Modern Trade (+3.0%).

In terms of top customers, +56.9% business is from top 10 customers, however 30% within top 10 customers declined in YTD

vs. LY. If we observe various regions, only Sharjah, Ajman and NE combined (+23.3%) grew. Rest all the other regions, Abu

Dhabi (-12.3%), Al Ain (-13.3%) and Dubai (-25.2%) declined vs. YTD LY.

Q1 2019 seemed quite challenging, starting from reducing the wholesale business dependency, delay in closing Carrefour

BDA, blocked accounts, CIW reduction, litigation against powder and shampoo. However to overcome these challenges we

have focused on other top customers like Union Coop by having dedicated Business Development resource since starting of

2019 to plan and increase the business. Currently, Union Coop has jumped the ranking to second biggest customer from

previously third or fourth biggest customer in UAE. Similarly we have an experienced e-Commerce resource to increase the

business in a new channel and lastly we have increased events and activations across all top doors in UAE. However we are

also hoping our business to grow with new line extensions, baby restage and penetration in Anti-bacterial category.

At the end, all the applauds to our entire team involved in Johnson & Johnson business for striving hard for success in this

tough and saturated market condition. We believe that no hardship can break our spirits and morale therefore tougher the

game the enthusiasm for victory becomes passion. We’ll keep our spirts high and aspire to perform even better than the

existing results. We would like to extend our gratitude to Albatha, Gulf International and Johnson & Johnson management for

their explicit support towards our 2019 first quarter journey.

*Data Source: Vicky Das – Senior Manager - Insights & Business Development