Page 54 - Investing in Praetura Group - Christopher Carter

P. 54

54

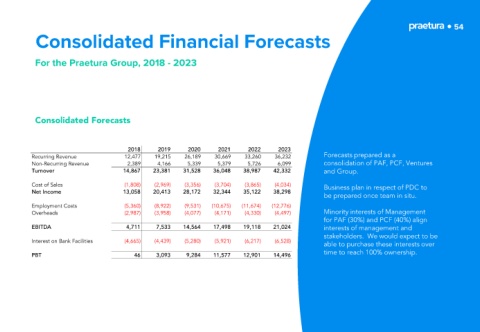

Consolidated Financial Forecasts

For the Praetura Group, 2018 - 2023

Consolidated Forecasts

2018 2019 2020 2021 2022 2023

Recurring Revenue 12,477 19,215 26,189 30,669 33,260 36,232 Forecasts prepared as a

Non-Recurring Revenue 2,389 4,166 5,339 5,379 5,726 6,099 consolidation of PAF, PCF, Ventures

Turnover 14,867 23,381 31,528 36,048 38,987 42,332 and Group.

Cost of Sales (1,808) (2,969) (3,356) (3,704) (3,865) (4,034) Business plan in respect of PDC to

Net Income 13,058 20,413 28,172 32,344 35,122 38,298

be prepared once team in situ.

Employment Costs (5,360) (8,922) (9,531) (10,675) (11,674) (12,776)

Overheads (2,987) (3,958) (4,077) (4,171) (4,330) (4,497) Minority interests of Management

for PAF (30%) and PCF (40%) align

EBITDA 4,711 7,533 14,564 17,498 19,118 21,024 interests of management and

stakeholders. We would expect to be

Interest on Bank Facilities (4,665) (4,439) (5,280) (5,921) (6,217) (6,528)

able to purchase these interests over

time to reach 100% ownership.

PBT 46 3,093 9,284 11,577 12,901 14,496