Page 57 - Investing in Praetura Group - Christopher Carter

P. 57

57

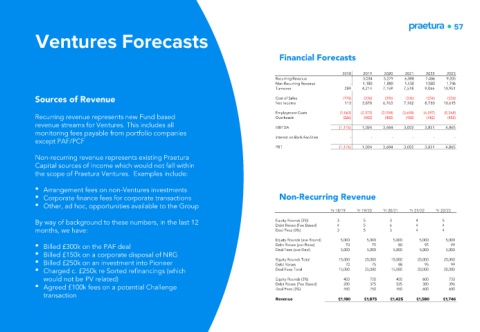

Ventures Forecasts

Financial Forecasts

2018 2019 2020 2021 2022 2023

Recurring Revenue 3,034 5,279 6,088 7,486 9,205

Non-Recurring Revenue - 1,180 1,880 1,430 1,580 1,746

Turnover 289 4,214 7,159 7,518 9,066 10,951

Sources of Revenue Cost of Sales (176) (336) (396) (336) (336) (336)

Net Income 113 3,878 6,763 7,182 8,730 10,615

Employment Costs (1,063) (2,372) (2,598) (3,698) (4,397) (5,268)

Recurring revenue represents new Fund based Overheads (226) (482) (482) (482) (482) (482)

revenue streams for Ventures. This includes all EBITDA (1,176) 1,024 3,684 3,002 3,851 4,865

monitoring fees payable from portfolio companies

except PAF/PCF Interest on Bank Facilities - - - - - -

PBT (1,176) 1,024 3,684 3,002 3,851 4,865

Non-recurring revenue represents existing Praetura

Capital sources of income which would not fall within

the scope of Praetura Ventures. Examples include:

• Arrangement fees on non-Ventures investments

• Corporate finance fees for corporate transactions Non-Recurring Revenue

• Other, ad hoc, opportunities available to the Group

Yr 18/19 Yr 19/20 Yr 20/21 Yr 21/22 Yr 22/23

By way of background to these numbers, in the last 12 Equity Rounds (3%) 3 4 5 5 3 6 4 4 5 4

Debt Raises (Fee Based)

months, we have: Deal Fees (3%) 3 5 3 4 4

Equity Rounds (ave Round) 5,000 5,000 5,000 5,000 5,000

80

95

70

99

• Billed £300k on the PAF deal Debt Raises (per Raise) 5,000 5,000 5,000 5,000 5,000

75

Deal Fees (ave Deal)

• Billed £150k on a corporate disposal of NRG

• Billed £250k on an investment into Pioneer Equity Rounds Total 15,000 25,000 15,000 20,000 25,000

75

95

88

99

Debt Raises

70

• Charged c. £250k re Sorted refinancings (which Deal Fees Total 15,000 25,000 15,000 20,000 20,000

would not be PV related) Equity Rounds (3%) 450 750 450 600 750

• Agreed £100k fees on a potential Challenge Debt Raises (Fee Based) 280 375 525 380 396

600

600

450

450

750

Deal Fees (3%)

transaction

Revenue £1,180 £1,875 £1,425 £1,580 £1,746