Page 62 - Investing in Praetura Group - Christopher Carter

P. 62

62

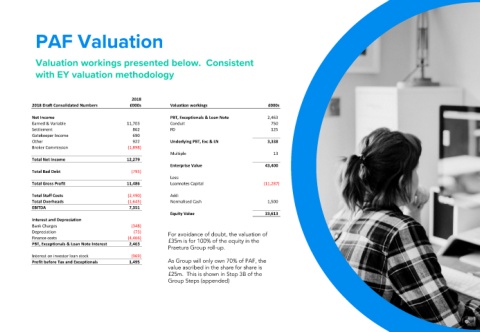

PAF Valuation

Valuation workings presented below. Consistent

with EY valuation methodology

2018

2018 Draft Consolidated Numbers £000s Valuation workings £000s

Net Income PBT, Exceptionals & Loan Note 2,463

Earned & Variable 11,703 Conduit 750

Settlement 862 FD 125

Gatekeeper Income 690

Other 922 Underlying PBT, Exc & LN 3,338

Broker Commission (1,898)

Multiple 13

Total Net Income 12,279

Enterprise Value 43,400

Total Bad Debt (793)

Less:

Total Gross Profit 11,486 Loannotes Capital (11,287)

Total Staff Costs (2,490) Add:

Total Overheads (1,645) Normalised Cash 1,500

EBITDA 7,351

Equity Value 33,613

Interest and Depreciation

Bank Charges (348)

Depreciation (73) For avoidance of doubt, the valuation of

Finance costs (4,466)

PBT, Exceptionals & Loan Note Interest 2,463 £35m is for 100% of the equity in the

Praetura Group roll-up.

Interest on investor loan stock (969)

Profit before Tax and Exceptionals 1,495 As Group will only own 70% of PAF, the

value ascribed in the share for share is

£25m. This is shown in Step 3B of the

Group Steps (appended)