Page 63 - Praetura EIS 2019 Fund Information Memorandum

P. 63

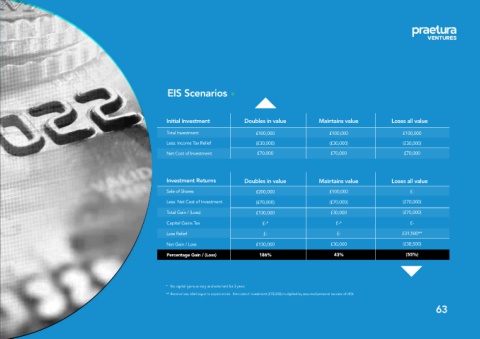

EIS Scenarios

Initial Investment Doubles in value Maintains value Loses all value

Total Investment £100,000 £100,000 £100,000

Less: Income Tax Relief (£30,000) (£30,000) (£30,000)

Net Cost of Investment £70,000 £70,000 £70,000

Investment Returns Doubles in value Maintains value Loses all value

Sale of Shares £200,000 £100,000 £-

Less: Net Cost of Investment (£70,000) (£70,000) (£70,000)

Total Gain / (Loss) £130,000 £30,000 (£70,000)

Capital Gains Tax £-* £-* £-

Loss Relief £- £- £31,500**

Net Gain / Loss £130,000 £30,000 (£38,500)

Percentage Gain / (Loss) 186% 43% (55%)

* No capital gains as long as shares held for 3 years

** Receive loss relief equal to capital at risk. Net cost of investment (£70,000) multiplied by assumed personal tax rate of 45%

63