Page 62 - Praetura EIS 2019 Fund Information Memorandum

P. 62

Praetura will ensure all investments made within

the Fund are suitable for EIS qualification

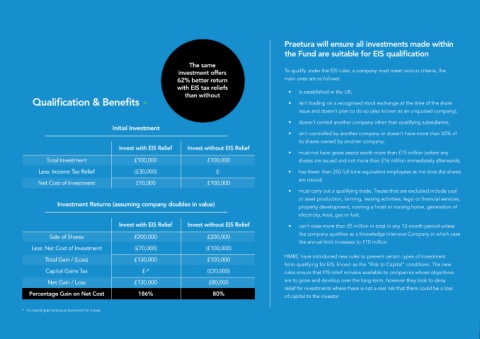

The same

investment offers To qualify under the EIS rules, a company must meet various criteria, the

62% better return main ones are as follows:

with EIS tax reliefs • is established in the UK;

than without

Qualification & Benefits • isn’t trading on a recognised stock exchange at the time of the share

issue and doesn’t plan to do so (also known as an unquoted company);

• doesn’t control another company other than qualifying subsidiaries;

Initial Investment

• isn’t controlled by another company or doesn’t have more than 50% of

its shares owned by another company;

Invest with EIS Relief Invest without EIS Relief

• must not have gross assets worth more than £15 million before any

Total Investment £100,000 £100,000 shares are issued and not more than £16 million immediately afterwards;

Less: Income Tax Relief (£30,000) £- • has fewer than 250 full-time equivalent employees at the time the shares

are issued;

Net Cost of Investment £70,000 £100,000

• must carry out a qualifying trade. Trades that are excluded include coal

or steel production, farming, leasing activities, legal or financial services,

Investment Returns (assuming company doubles in value) property development, running a hotel or nursing home, generation of

electricity, heat, gas or fuel;

Invest with EIS Relief Invest without EIS Relief • can’t raise more than £5 million in total in any 12-month period unless

the company qualifies as a Knowledge Intensive Company in which case

Sale of Shares £200,000 £200,000

the annual limit increases to £10 million.

Less: Net Cost of Investment (£70,000) (£100,000)

HMRC have introduced new rules to prevent certain types of investment

Total Gain / (Loss) £130,000 £100,000

from qualifying for EIS, known as the “Risk to Capital” conditions. The new

Capital Gains Tax £-* (£20,000) rules ensure that EIS relief remains available to companies whose objectives

are to grow and develop over the long-term, however they look to deny

Net Gain / Loss £130,000 £80,000

relief for investments where there is not a real risk that there could be a loss

Percentage Gain on Net Cost 186% 80% of capital to the investor

* No capital gains as long as shares held for 3 years