Page 61 - Praetura EIS 2019 Fund Information Memorandum

P. 61

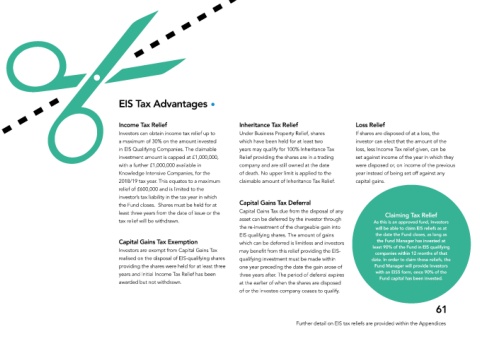

EIS Tax Advantages

Income Tax Relief Inheritance Tax Relief Loss Relief

Investors can obtain income tax relief up to Under Business Property Relief, shares If shares are disposed of at a loss, the

a maximum of 30% on the amount invested which have been held for at least two investor can elect that the amount of the

in EIS Qualifying Companies. The claimable years may qualify for 100% Inheritance Tax loss, less Income Tax relief given, can be

investment amount is capped at £1,000,000, Relief providing the shares are in a trading set against income of the year in which they

with a further £1,000,000 available in company and are still owned at the date were disposed or, on income of the previous

Knowledge Intensive Companies, for the of death. No upper limit is applied to the year instead of being set off against any

2018/19 tax year. This equates to a maximum claimable amount of Inheritance Tax Relief. capital gains.

relief of £600,000 and is limited to the

investor’s tax liability in the tax year in which

the Fund closes. Shares must be held for at Capital Gains Tax Deferral

least three years from the date of issue or the Capital Gains Tax due from the disposal of any Claiming Tax Relief

tax relief will be withdrawn. asset can be deferred by the investor through As this is an approved fund, Investors

the re-investment of the chargeable gain into will be able to claim EIS reliefs as at

EIS qualifying shares. The amount of gains the date the Fund closes, as long as

Capital Gains Tax Exemption which can be deferred is limitless and investors the Fund Manager has invested at

Investors are exempt from Capital Gains Tax may benefit from this relief providing the EIS- least 90% of the Fund in EIS qualifying

companies within 12 months of that

realised on the disposal of EIS-qualifying shares qualifying investment must be made within date. In order to claim those reliefs, the

providing the shares were held for at least three one year preceding the date the gain arose of Fund Manager will provide Investors

years and initial Income Tax Relief has been three years after. The period of deferral expires with an EIS5 form, once 90% of the

awarded but not withdrawn. at the earlier of when the shares are disposed Fund capital has been invested.

of or the investee company ceases to qualify.

61

Further detail on EIS tax reliefs are provided within the Appendices