Page 76 - Praetura EIS 2019 Fund Information Memorandum

P. 76

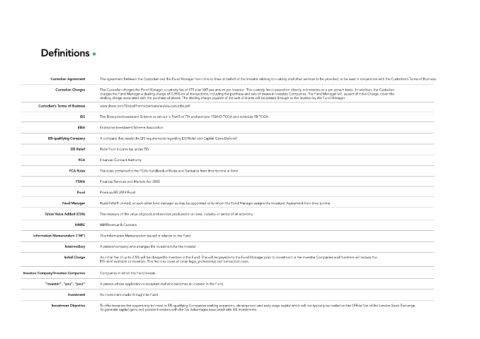

Definitions

Custodian Agreement The agreement between the Custodian and the Fund Manager from time to time on behalf of the Investor relating to custody and other services to be provided, to be read in conjunction with the Custodian’s Terms of Business.

Custodian Charges The Custodian charges the Fund Manager a custody fee of £75 plus VAT per annum per Investor. This custody fee is passed on directly to Investors on a per annum basis. In addition, the Custodian

charges the Fund Manager a dealing charge of 0.35% on all transactions, including the purchase and sale of shares in Investee Companies. The Fund Manager will, as part of Initial Charge, cover the

dealing charge associated with the purchase of shares. The dealing charge payable of the sale of shares will be passed through to the Investor by the Fund Manager.

Custodian’s Terms of Business www.share.com/Global/Forms/partners/eis/eis-cust-tobs.pdf

EIS The Enterprise Investment Scheme as set out in Part 5 of ITA and sections 150A-D TCGA and schedule 5B TCGA

EISA Enterprise Investment Scheme Association

EIS-qualifying Company A company that meets the EIS requirements regarding EIS Relief and Capital Gains Deferral

EIS Relief Relief from income tax under EIS

FCA Financial Conduct Authority

FCA Rules The rules contained in the FCA’s Handbook of Rules and Guidance from time to time in force

FSMA Financial Services and Markets Act 2000

Fund Praetura EIS 2019 Fund

Fund Manager Rudolf Wolff Limited, or such other fund manager as may be appointed or to whom the Fund Manager assigns the Investors’ Agreement from time to time

Gross Value Added (GVA) The measure of the value of goods and services produced in an area, industry or sector of an economy

HMRC HM Revenue & Customs

Information Memorandum (“IM”) This Information Memorandum issued in relation to the Fund

Intermediary A person/company who arranges the investment for the Investor

Initial Charge An initial fee of up to 2.5% will be charged to Investors in the Fund. This will be payable to the Fund Manager prior to investment in the Investee Companies and therefore will reduce the

EIS relief available to Investors. This fee is to cover all initial legal, professional and transaction costs.

Investee Company/Investee Companies Companies in which the Fund invests

“Investor”, “you”, “your” A person whose application is accepted and who becomes an investor in the Fund

Investment An investment made through the Fund

Investment Objective To offer investors the opportunity to invest in EIS-qualifying Companies seeking expansion, development and early stage capital which will not typically be traded on the Official List of the London Stock Exchange.

To generate capital gains and provide Investors with the Tax Advantages associated with EIS Investments.