Page 77 - Praetura EIS 2019 Fund Information Memorandum

P. 77

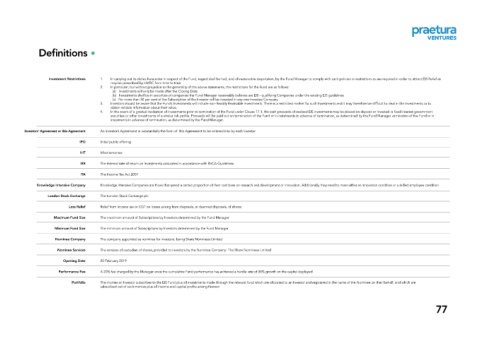

Definitions

Investment Restrictions 1. In carrying out its duties hereunder in respect of the Fund, regard shall be had, and all reasonable steps taken, by the Fund Manager to comply with such policies or restrictions as are required in order to attract EIS Relief as

may be prescribed by HMRC from time to time.

2. In particular, but without prejudice to the generality of the above statements, the restrictions for the Fund are as follows:

(a) Investments will only be made after the Closing Date

(b) Investments shall be in securities of companies the Fund Manager reasonably believes are EIS - qualifying Companies under the existing EIS guidelines

(c) No more than 30 per cent of the Subscription of the Investor will be invested in any one Investee Company

3. Investors should be aware that the Fund’s Investments will include non-Readily Realisable Investments. There is a restricted market for such Investments and it may therefore be difficult to deal in the Investments or to

obtain reliable information about their value.

4. In the event of a gradual realisation of Investments prior to termination of the Fund under Clause 17.1, the cash proceeds of realised EIS investments may be placed on deposit or invested in fixed interest government

securities or other investments of a similar risk profile. Proceeds will be paid out on termination of the Fund or in instalments in advance of termination, as determined by the Fund Manager. ermination of the Fund or in

instalments in advance of termination, as determined by the Fund Manager.

Investors’ Agreement or this Agreement An Investor’s Agreement in substantially the form of this Agreement to be entered into by each Investor

IPO Initial public offering

IHT Inheritance tax

IRR The internal rate of return on investments calculated in accordance with BVCA Guidelines

ITA The Income Tax Act 2007

Knowledge Intensive Company Knowledge Intensive Companies are those that spend a certain proportion of their cost base on research and development or innovation. Additionally, they need to meet either an innovation condition or a skilled employee condition

London Stock Exchange The London Stock Exchange plc

Loss Relief Relief from income tax or CGT on losses arising from disposals, or deemed disposals, of shares

Maximum Fund Size The maximum amount of Subscriptions by Investors determined by the Fund Manager

Minimum Fund Size The minimum amount of Subscriptions by Investors determined by the Fund Manager

Nominee Company The company appointed as nominee for investors: being Share Nominees Limited

Nominee Services The services of custodian of shares, provided to investors by the Nominee Company: The Share Nominees Limited

Opening Date 20 February 2019

Performance Fee A 20% fee charged by the Manager once the cumulative Fund performance has achieved a hurdle rate of 30% growth on the capital deployed

Portfolio The monies an Investor subscribes to the EIS Fund plus all investments made through the relevant fund which are allocated to an Investor and registered in the name of the Nominee on their behalf, and which are

subscribed out of such monies plus all income and capital profits arising thereon

77