Page 219 - All SFAC DOC file

P. 219

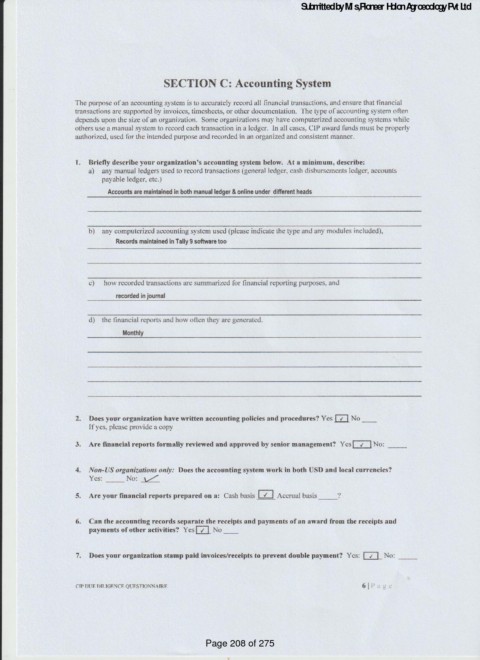

Submitted by M/s,Pioneer Holon Agroecology Pvt Ltd

SECTION C: Accounting System

The purpose of an accounting system is to accurately record all financial transactions, and ensure that financial

transactions are supported by invoices, timeshccts, or other documentation. The type of accounting system often

depends upon the size of an organization, Some organizations may have computerized accounting systems while

others use a manual system to record cach transaction in a ledger. In all cases, CIP award funds must be properly

authorized, used for the intended purpose and recorded in an organized and consistent manner.

1. Briefly describe your organization's accounting system below. At a minimum, describe:

a) any manual ledgers used to record transactions (general ledger, cash disbursements ledger, accounts

payable ledger, etc.)

Accounts are maintained in both manual ledger & online under different heads

b) any computerized accounting system used (please indicate the type and any modules included),

Records maintained in Tally 9 software too

c) how recorded transactions are summarized for financial reporting purposes, and

recorded in journal

d) the financial reports and how often they are generated.

Monthly

2. Does your organization have written accounting policies and procedures? Yes [] No _

If yes, pleasc provide a copy

3. Are financial reports formally reviewed and approved by senior management? Yes[]No:

4. Non-US organizations only: Does the accounting system work in both [SD and local curreneies?

Yes: No: L-

5. Are your financial reports prepared on a: Cash basis [4 ] Accrual basis ?

6. Can the accounting records separate the receipts and payments of an award from the receipts and

payments of other activities? Yes[] No_

7, Does your organization stamp paid invoices/receipts to prevent double payment? Yes: [_No:

CI DUE DIL IGFCF QUESTIONNAIRF 6Pa e

Page 208 of 275