Page 125 - Bahrain Gov Annual Reports (II)_Neat

P. 125

35

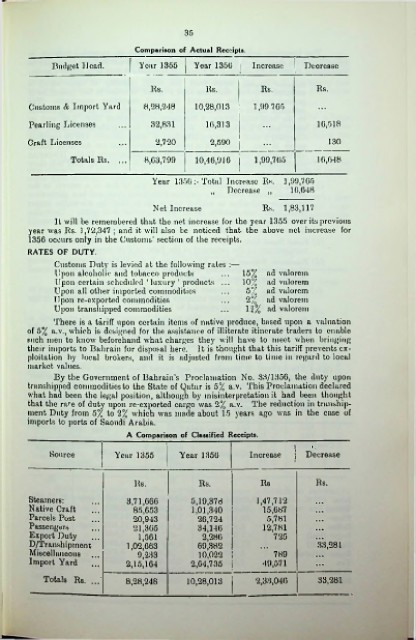

Comparison of Actual Receipts.

Budget Head. Year 1355 Year 1350 Increase Deorease

Rs. Rs. Rs. Rs.

Customs & Import Yard 8/28,248 10,28,013 1,99 765

Pearling Licenses • • 32,831 10,313 10,518

Craft Licenses 2,720 2,590 130

Totals Rs. ... 8,03,799 10,46,916 I 1,99,705 10,048

Year 1356:-Total Increase Rs. 1,99,705

„ Decrease „ 10,048

Net Increase Rs. 1,83,117

It will be remembered that the net increase for the year 1355 over its previous

year was Rs. 1,72,347 ; and it will also be noticed that the above net increase for

1356 occurs only in the Customs’ section of the receipts.

RATES OF DUTY.

Customs Duty is levied at the following rates :—

Upon alcoholic and tobacco products ... 15% ad valorem

Upon certain scheduled ‘luxury ’ products ... 10% ad valorem

Upon all other imported commodities ... 5% ad valorem

Upon re-exported commodities ... 2% ad valorem

Upon transhipped commodities ... 11% ad valorem

There is a tariff upon certain items of native produce, based upon a valuation

of 5% a.v., which is designed for the assistance of illiterate itinerate traders to enable

such men to know beforehand what charges they will have to meet when bringing

their imports to Bahrain for disposal here. It is thought that this tariff prevents ex

ploitation by local brokers, and it is adjusted from time to time in regard to local

market values.

By the Government of Bahrain’s Proclamation No. 33/1356, the duty upon

transhipped commodities to the State of Qatar is 5% a.v. This Proclamation declared

what had been the legal position, although by misinterpretation it had been thought

that the rare of duty upon re-exported cargo was 2% a.v. The reduction in tranship

ment Duty from 5% to 2% which was made about 15 years ago was in the case of

imports to ports of Saoudi Arabia.

A Comparison of Classified Receipts.

Source Year 1355 Year 1350 Increase : Decrease

Rs. Rs. Re Rs.

Steamers: 3,71,060 5,19,378 1,47,712

Native Craft 85,653 1,01,340 15,087

Parcels Post 20,943 26,724 5,781

Passengers 21,305 34,140 12,781

Export Duty 1,561 2,280 725

D/Transhipinenti 1,02,663 69,382 33,281

Miscellaneous 9,233 10,022 i 789

Import Yard 2,15,164 2,64,735 i 49,571

Totals Rs. ...' 8,28,248 10,28,013 2,33,040 33,281