Page 137 - Bahrain Gov Annual Reports (II)_Neat

P. 137

47

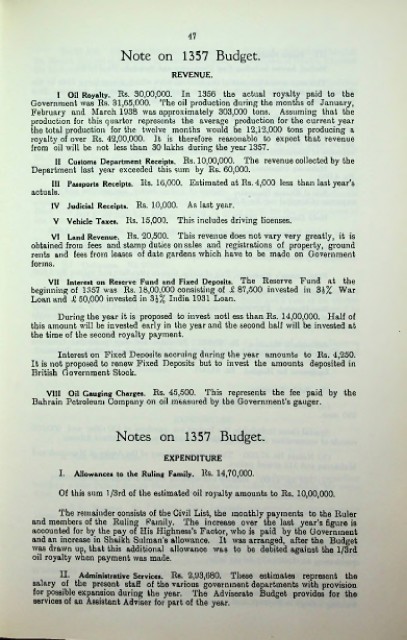

Note on 1357 Budget.

REVENUE.

I Oil Royalty. Rs. 30,00,000. In 1356 the actual royalty paid to the

Government was Rs. 31,65,000. The oil production during the months of January,

February and March 1938 was approximately 303,000 tons. Assuming that the

production for this quarter represents the average production for the current year

the total production for the twelve months would be 12,12,000 tons producing a

royalty of over Rs. 42,00,000. It is therefore reasonable to expect that revenue

from oil will be not less than 30 lakhs during the year 1357.

II Customs Department Receipts. Rs. 10,00,000. The revenue collected by the

Department last year exceeded this sum by Rs. 60,000.

Ill Passports Receipts. Rs. 16,000. Estimated at Rs. 4,000 less than last year's

actuals.

IV Judicial Receipts. Rs. 10,000. As last year.

V Vehicle Taxes. Rs. 15,000. This includes driving licenses.

VI Land Revenue. Rs. 20,500. This revenue does not vary very greatly, it is

obtained from fees and stamp duties on sales and registrations of property, ground

rents and fees from leases of date gardens which have to be made on Government

forms.

VII Interest on Reserve Fund and Fixed Deposits. The Reserve Fund at the

beginning of 1357 was Rs. 18,00,000 consisting of T 87,500 invested in 31% War

Loan and £ 50,000 invested in 31% India 1931 Loan.

During the year it is proposed to invest notl ess than Rs. 14,00,000. Half of

this amount will be invested early in the year and the second half will be invested at

the time of the second royalty payment.

Interest on Fixed Deposits accruing during the year amounts to Rs. 4,250.

It is not proposed to renew Fixed Deposits but to invest the amounts deposited in

British Government Stock.

VIII Oil Gauging Charges. Rs. 45,500. This represents the fee paid by the

Bahrain Petroleum Company on oil measured by the Government’s gauger.

Notes on 1357 Budget.

EXPENDITURE

I. Allowances to the Ruling Family. Rs. 14,70,000.

Of this sum l/3rd of the estimated oil royalty amounts to Rs. 10,00,000.

The remainder consists of the Civil List, the monthly payments to the Ruler

and members of the Ruling Family. The increase over the last year’s figure is

accounted for by the pay of His Highness’s Factor, who is paid by the Government

and an increase in Shaikh Sulman’s allowance. It was arranged, after the Budget

was drawn up, that this additional allowance was to be debited against the l/3rd

oil royalty when payment was made.

II. Administrative Services. Rs. 2,93,680. These estimates represent the

salary of the present staff of the various government departments with provision

for possible expansion during the year. The Adviserate Budget provides for the

services of an Assistant Adviser for part of the year.