Page 130 - The Persian Gulf Historical Summaries (1907-1953) Vol III

P. 130

125

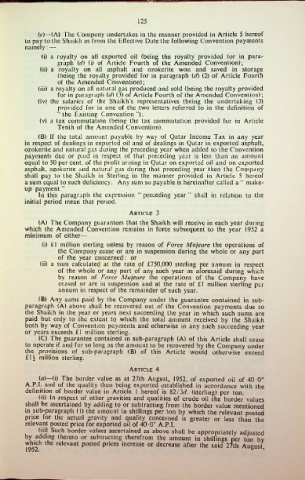

(c)—(A) The Company undertakes in the manner provided in Article 5 hereof

to pay to the Shaikh as from the Effective Date the following Convention payments

namely: —

(i) a royalty on all exported oil (being the royalty provided for in para

graph ((/) (i) of Article Fourth of the Amended Convention);

(ii) a royalty on all asphalt and ozokerite won and saved in storage

(being the royalty provided for in paragraph (cl) (2) of Article Fourth

of the Amended Convention);

(iii) a royalty on all natural gas produced and sold (being the royalty provided

for in paragraph (cl) (3) of Article Fourth of the Amended Convention);

(iv) the salaries of the Shaikh’s representatives (being the undertaking (3)

provided for in one of the two letters referred to in the definition of

“the Existing Convention”);

(v) a tax commutation (being the tax commutation provided for in Article

Tenth of the Amended Convention).

(B) If the total amount payable by way of Qatar Income Tax in any year

in respect of dealings in exported oil and of dealings in Qatar in exported asphalt,

ozokerite and natural gas during the preceding year when added to the Convention

payments due or paid in respect of that preceding year is less than an amount

equal to 50 per cent, of the profit arising in Qatar on exported oil and on exported

asphalt, ozokerite and natural gas during that preceding year then the Company

shall pay to the Shaikh in Sterling in the manner provided in Article 5 hereof

a sum equal to such deficiency. Any sum so payable is hereinafter called a “ make

up payment.”

In this paragraph the expression “ preceding year ” shall in relation to the

initial period mean that period.

Article 3

(A) The Company guarantees that the Shaikh will receive in each year during

which the Amended Convention remains in force subsequent to the year 1952 a

minimum of either—

(i) £1 million sterling unless by reason of Force Mcijeure the operations of

the Company cease or are in suspension during the whole or any part

of the year concerned: or

(ii) a sum calculated at the rate of £750,000 sterling per annum in respect

of the whole or any part of any such year as aforesaid during which

by reason of Force Mcijeure the operations of the Company have

ceased or are in suspension and at the rate of £1 million sterling per

annum in respect of the remainder of such year.

(B) Any sums paid by the Company under the guarantee contained in sub-

paragraph (A) above shall be recovered out of the Convention payments due to

the Shaikh in the year or years next succeeding the year in which such sums are

paid but only to the extent to which the total amount received by the Shaikh

both by way of Convention payments and otherwise in any such succeeding year

or years exceeds £1 million sterling.

(C) The guarantee contained in sub-paragraph (A) of this Article shall cease

to operate if and for so long as the amount to be recovered by the Company under

the provisions of sub-paragraph (B) of this Article would otherwise exceed

£1J- million sterling.

Article 4

(«)—(i) The border value as at 27th August, 1952, of exported oil of 40 0°

A.P.I. and of the quality then being exported established in accordance with the

definition of border value in Article 1 hereof is 8213d. (sterling) per ton.

(ii) In respect of other gravities and qualities of crude oil the border values

shall be ascertained by adding to or subtracting from the border value mentioned

in sub-paragraph (I) the amount in shillings per ton by which the relevant posted

price for the actual gravity and quality concerned is greater or less than the

relevant posted price for exported oil of 40*0° A.P.I.

<jjj> Such border values ascertained as above shall be appropriately adjusted

by adding thereto or subtracting therefrom the amount in shillings per ton by

which the relevant posted prices increase or decrease after the said 27th August