Page 38 - The Persian Gulf Historical Summaries (1907-1953) Vol III

P. 38

35

(d)

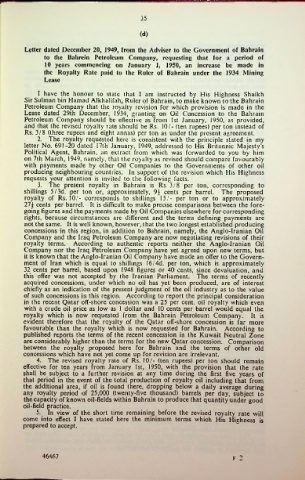

Letter dated December 20, 1949, from the Adviser to the Government of Bahrain

to the Bahrein Petroleum Company, requesting that for a period of

10 years commencing on January 1, 1950, an increase be made in

the Royalty Rate paid to the Ruler of Bahrain under the 1934 Mining

Lease

I have the honour to state that I am instructed by His Highness Shaikh

Sir Sulman bin Hamad Alkhalifah, Ruler of Bahrain, to make known to the Bahrain

Petroleum Company that the royalty revision for which provision is made in the

Lease dated 29th December, 1934, granting on Oil Concession to the Bahrain

Petroleum Company should be effective as from 1st January, 1950, as provided,

and that the revised royalty rate should be Rs. 10/- (ten rupees) per ton instead of

Rs. 3/8 (three rupees and eight annas) per ton as under the present agreement.

2. The royalty requested here is consistent with the principle stated in my

letter No. 691-20 dated 17th January, 1949, addressed to His Britannic Majesty’s

Political Agent, Bahrain, an extract from which was forwarded to you by him

on 7th March, 1949, namely, that the royalty as revised should compare favourably

with payments made by other Oil Companies to the Governments of other oil

producing neighbouring countries. In support of the revision which His Highness

requests your attention is invited to the following facts.

3. The present royalty in Bahrain is Rs. 3/8 per ton, corresponding to

shillings 5/3d. per ton or, approximately, cents per barrel. The proposed

royalty of Rs. 10/- corresponds to shillings 15/- per ton or to approximately

27$ cents per barrel. It is difficult to make precise comparisons between the fore

going figures and the payments made by Oil Companies elsewhere for corresponding

rights, because circumstances are different and the terms defining payments are

not the same. It is well known, however, that the two longest established producing

concessions in this region, in addition to Bahrain, namely, the Anglo-Iranian Oil

Company and the Iraq Petroleum Company are now negotiating revisions of their

royalty terms. According to authentic reports neither the Anglo-Iranian Oil

Company nor the Iraq Petroleum Company have yet agreed upon new terms, but

it is known that the Anglo-Iranian Oil Company have made an ofTer to the Govern

ment of Iran which is equal to shillings 16/4d. per ton, which is approximately

32 cents per barrel, based upon 1948 figures or 40 cents, since devaluation, and

this offer was not accepted by the Iranian Parliament. The terms of recently

acquired concessions, under which no oil has yet been produced, are of interest

chiefly as an indication of the present judgment of the oil industry as to the value

of such concessions in this region. According to report the principal consideration

in the recent Qatar off-shore concession was a 25 per cent, oil royalty which even

with a crude oil price as low as 1 dollar and 10 cents per barrel would equal the

royalty which is now requested from the Bahrain Petroleum Company. It is

evident therefore that the royalty of the Qatar off-shore concession is far more

favourable than the royalty which is now requested for Bahrain. According to

published reports the terms of the recent concession in the Kuwait Neutral Zone

are considerably higher than the terms for the new Qatar concession. Comparison

between the royalty proposed here for Bahrain and the terms of other old

concessions which have not yet come up for revision are irrelevant.

4. The revised royalty rate of Rs. 10/- (ten rupees) per ton should remain

effective for ten years from January 1st, 1950, with the provision that the rate

shall be subject to a further revision at any time during the first five years of

that period in the event of the total production of royalty oil including that from

the additional area, if oil is found there, dropping below a daily average during

any royalty period of 25,000 (twenty-five thousand) barrels per day, subject to

the capacity of known oil-fields within Bahrain to produce that quantity under good

oil-field practice.

5. In view of the short time remaining before the revised royalty rate will

come into effect I have stated here the minimum terms which His Highness is

prepared to accept.

46467 F 2