Page 33 - The Persian Gulf Historical Summaries (1907-1953) Vol III

P. 33

30

(a)

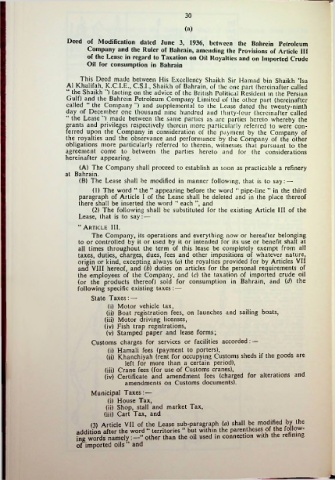

Deed of Modification dated June 3, 1936, between the Bahrein Petroleum

Company and the Ruler of Bahrain, amending the Provisions of Article III

of the Lease in regard to Taxation on Oil Royalties and on Imported Crude

Oil for consumption in Bahrain

This Deed made between His Excellency Shaikh Sir Hamad bin Shaikh ’Isa

A1 Khalifah, K.C.I.E., C.S.I., Shaikh of Bahrain, of the one part (hereinafter called

“ the Shaikh ’) (acting on the advice of the British Political Resident in the Persian

Gulf) and the Bahrein Petroleum Company Limited of the other part (hereinafter

called “ the Company ”) and supplemental to the Lease dated the twenty-ninth

day of December one thousand nine hundred and thirty-four (hereinafter called

“ the Lease ”) made between the same parties as are parties hereto whereby the

grants and privileges respectively therein more particularly referred to were con-

ferred upon the Company in consideration of the payment by the Company of

the royalties and the observance and performance by the Company of the other

obligations more particularly referred to therein, witnesses that pursuant to the

agreement come to between the parties hereto and for the considerations

hereinafter appearing.

(A) The Company shall proceed to establish as soon as practicable a refinery

at Bahrain.

(B) The Lease shall be modified in manner following, that is to say: —

(1) The word “ the ” appearing before the word “ pipe-line ” in the third

paragraph of Article I of the Lease shall be deleted and in the place thereof

there shall be inserted the word “ each ”, and

(2) The following shall be substituted for the existing Article III of the

Lease, that is to say: —

“ Article III.

The Company, its operations and everything now or hereafter belonging

to or controlled by it or used by it or intended for its use or benefit shall at

all times throughout the term of this lease be completely exempt from all

taxes, duties, charges, dues, fees and other impositions of whatever nature,

origin or kind, excepting always (a) the royalties provided for by Articles VII

and VIII hereof, and (b) duties on articles for the personal requirements of

the employees of the Company, and (c) the taxation of imported crude oil

(or the products thereof) sold for consumption in Bahrain, and (d) the

following specific existing taxes: —

State Taxes: —

(i) Motor vehicle tax,

(ii) Boat registration fees, on launches and sailing boats,

(iii) Motor driving licenses,

(iv) Fish trap registrations,

(v) Stamped paper and lease forms;

Customs charges for services or facilities accorded: —

(i) Hamali fees (payment to porters),

(ii) Khanchiyah (rent for occupying Customs sheds if the goods are

left for more than a certain period),

(iii) Crane fees (for use of Customs cranes),

(iv) Certificate and amendment fees (charged for alterations and

amendments on Customs documents).

Municipal Taxes: —

(i) House Tax,

(ii) Shop, stall and market Tax,

(iii) Cart Tax, and

(3) Article VII of the Lease sub-paragraph (a) shall be modified by the

addition after the word “ territories ” but within the parentheses of the follow

ing words namely:—■“ other than the oil used in connection with the refining

of imported oils ” and