Page 434 - Bahrain Gov Annual Reports (III)_Neat

P. 434

28

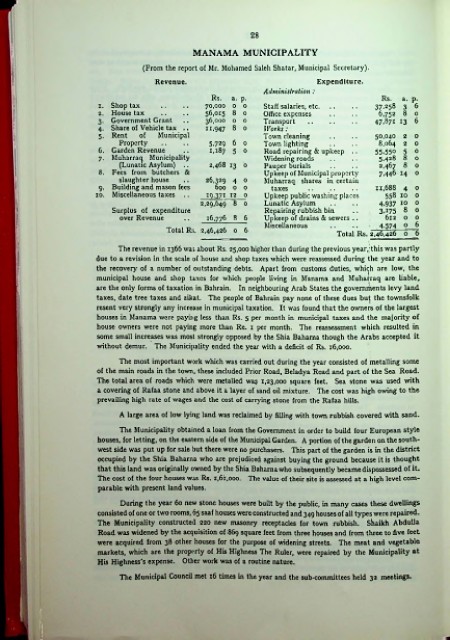

MANAMA MUNICIPALITY

(From the report of Mr. Mohamed Saleh Shatar, Municipal Secretary).

Revenue. Expenditure.

Administration:

Rs. a. p. Rs. a. p.

1. Shop tax 70.000 0 o Staff salaries; etc..................... 37.258 3 6

2. House tax 56.015 8 0 Office expenses 6,752 8 o

3. Government Grant 36.000 0 0 Transport ........................... 47.871 13 6

4. Share of Vehicle tax .. 11,947 8 0 Works:

5. Rent of Municipal Town cleaning 50,040 2 o

Property 5,729 6 0 Town lighting 8,064 2 0

6. Garden Revenue 1,187 5 0 Road repairing & upkeep .. 55.550 5 o

7. Muharracj Municipality Widening roads 5.428 8 o

(Lunatic Asylum) .. 2,468 13 0 Pauper burials 2,467 8 o

8. Fees from butchers & Upkeep of Municipal property 7.446 14 o

slaughter house 26,329 4 0 Muharraq shares in certain

9. Building and mason fees 600 0 0 taxes ........................... 11,688 4 o

10. Miscellaneous taxes .. 19,371 12 0 Upkeep public washing places 558 10 o

2,29,649 8 0 Lunatic Asylum 4.937 10 o

Surplus of expenditure Repairing rubbish bin 3.175 8 o

over Revenue 16,776 8 6 Upkeep of drains & sewers .. 612 0 o

Miscellaneous 4.574 o 6

Total Rs. 2,46,426 0 6

Total Rs. 2,46,426 o o

The revenue in 1366 was about Rs. 25,000 higher than during the previous year,’this was partly

due to a revision in the scale of house and shop taxes which were reassessed during the year and to

the recovery of a number of outstanding debts. Apart from customs duties, whi<jh are low, the

municipal house and shop taxes for which people living in Manama and Muharraq are liable,

are the only forms of taxation in Bahrain. In neighbouring Arab States the governments levy land

taxes, date tree taxes and zikat. The people of Bahrain pay none of these dues bu^ the townsfolk

resent very strongly any increase in municipal taxation. It was found that the owners of the largest

houses in Manama were paying less than Rs. 5 per month in municipal taxes and the majority of

house owners were not paying more than Re. 1 per month. The reassessment which resulted in

some small increases was most strongly opposed by the Shia Bahama though the Arabs accepted it

without demur. The Municipality ended the year with a deficit of Rs. 16,000.

The most important work which was carried out during the year consisted of metalling some

of the main roads in the town, these included Prior Road, Beladya Road and part of the Sea Road.

The total area of roads which were metalled wa$ 1,23,000 square feet. Sea stone was used with

a covering of Rafaa stone and above it a layer of sand oil mixture. The cost was high owing to the

prevailing high rate of wages and the cost of carrying stone from the Rafaa hills.

A large area of low lying land was reclaimed by filling with town rubbish covered with sand.

The Municipality obtained a loan from the Government in order to build four European style

houses, for letting, on the eastern side of the Municipal Garden. A portion of the garden on the south

west side was put up for sale but there were no purchasers. This part of the garden is in the district

occupied by the Shia Bahama who are prejudiced against buying the ground because it is thought

that this land was originally owned by the Shia Bahama who subsequently became dispossessed of it.

The cost of the four houses was Rs. 1,61,000. The value of their site is assessed at a high level com

parable with present land values.

During the year 60 new stone houses were built by the public, in many cases these dwellings

consisted of one or two rooms, 65 saaf houses were constructed and 349 houses of all types were repaired.

The Municipality constructed 220 new masonry receptacles for town rubbish. Shaikh Abdulla

Road was widened by the acquisition of 869 square feet from three houses and from three to five feet

were acquired from 38 other houses for the purpose of widening streets. The meat and vegetable

markets, which are the property of His Highness The Ruler, were repaired by the Municipality at

His Highness’s expense. Other work was of a routine nature.

The Municipal Council met 16 times in the year and the sub-committees held 32 meetings.

■