Page 437 - Bahrain Gov Annual Reports (III)_Neat

P. 437

29

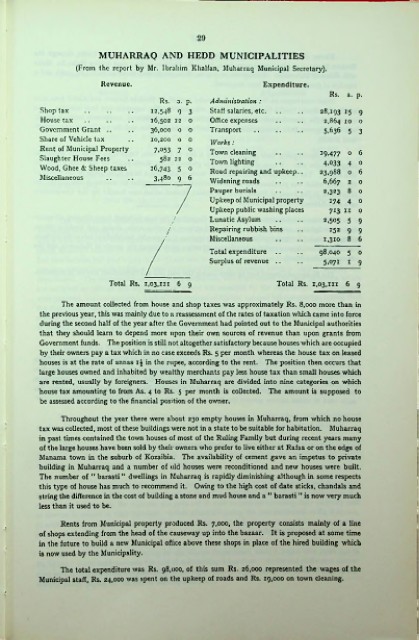

MUHARRAQ AND HEDD MUNICIPALITIES

(From the report by Mr. Ibrahim Khalfan, Muharraq Municipal Secretary).

Revenue. Expenditure.

Rs. a. p.

Rs. a. p. Administration :

Shop tax 12,548 9 3 Staff salaries, etc. 28.193 15 9

House tax........................ 16,502 12 o Office expenses 2,864 30 0

Government Grant ... 36,000 0 0 Transport .......................... 5.636 5 3

Share of Vehicle tax 10,200 0 0

Works:

Rent of Municipal Property 7.053 7 0 Town cleaning 39.477 o 6

Slaughter House Fees 582 12 o

Town lighting 4.033 4 o

Wood, Ghee & Sheep taxes 36,743 5 0 Road repairing and upkeep.. 23,988 0 6

Miscellaneous 3,480 9 6

Widening roads 6,667 2 o

Pauper burials 2,323 8 0

Upkeep of Municipal property 174 4 0

Upkeep public washing places 713 ii 0

/ Lunatic Asylum 2,505 5 9

/ Repairing rubbish bins 152 9 9

Miscellaneous 1,310 8 6

Total expenditure 98,040 5 0

Surplus of revenue 5.071 1 9

Total Rs. 1,03,111 6 9 Total Rs. 1,03,111 6 9

The amount collected from house and shop taxes was approximately Rs. 8,000 more than in

the previous year, this was mainly due to a reassessment of the rates of taxation which came into force

during the second half of the year after the Government had pointed out to the Municipal authorities

that they should learn to depend more upon their own sources of revenue than upon grants from

Government funds. The position is still not altogether satisfactory because houses which are occupied

by their owners pay a tax which in no case exceeds Rs. 5 per month whereas the house tax on leased

houses is at the rate of annas 1$ in the rupee, according to the rent. The position then occurs that

large houses owned and inhabited by wealthy merchants pay less house tax than small houses which

are rented, usually by foreigners. Houses in Muharraq are divided into nine categories on which

house tax amounting to from As. 4 to Rs. 5 per month is collected. The amount is supposed to

be assessed according to the financial position of the owner.

Throughout the year there were about 230 empty houses in Muharraq, from which no house

tax was collected, most of these buildings were not in a state to be suitable for habitation. Muharraq

in past times contained the town houses of most of the Ruling Family but during recent years many

of the large houses have been sold by their owners who prefer to live either at Rafaa or on the edge of

Manama town in the suburb of Kozaibia. The availability of cement gave an impetus to private

building in Muharraq and a number of old houses were reconditioned and new houses were built.

The number of “ barasti ” dwellings in Muharraq is rapidly diminishing although in some respects

this type of house has much to recommend it. Owing to the high cost of date sticks, chandals and

string the difference in the cost of building a stone and mud house and a " barasti ’* is now very much

less than it used to be.

Rents from Municipal property produced Rs. 7,000, the property consists mainly of a line :

of shops extending from the head of the causeway up into the bazaar. It is proposed at some time

in the future to build a new Municipal office above these shops in place of the hired building which

is now used by the Municipality.

The total expenditure was Rs. 98,000, of this sum Rs. 26,000 represented the wages of the

Municipal staff, Rs. 24,000 was spent on the upkeep of roads and Rs. 19,000 on town cleaning.

i