Page 49 - BAA CAFR 2017

P. 49

BIRMINGHAM AIRPORT AUTHORITY

NOTES TO THE FINANCIAL STATEMENTS

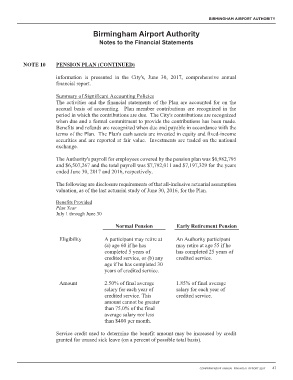

NOTE 10 PENSION PLAN (CONTINUED)

information is presented in the City's, June 30, 2017, comprehensive annual

financial report.

Summary of Significant Accounting Policies

The activities and the financial statements of the Plan are accounted for on the

accrual basis of accounting. Plan member contributions are recognized in the

period in which the contributions are due. The City's contributions are recognized

when due and a formal commitment to provide the contributions has been made.

Benefits and refunds are recognized when due and payable in accordance with the

terms of the Plan. The Plan's cash assets are invested in equity and fixed-income

securities and are reported at fair value. Investments are traded on the national

exchange.

The Authority's payroll for employees covered by the pension plan was $6,982,795

and $6,507,267 and the total payroll was $7,792,011 and $7,197,329 for the years

ended June 30, 2017 and 2016, respectively.

The following are disclosure requirements of that all-inclusive actuarial assumption

valuation, as of the last actuarial study of June 30, 2016, for the Plan.

Benefits Provided

Plan Year

July 1 through June 30

Normal Pension Early Retirement Pension

Eligibility A participant may retire at An Authority participant

(a) age 60 if he has may retire at age 55 if he

completed 5 years of has completed 25 years of

credited service, or (b) any credited service.

age if he has completed 30

years of credited service.

Amount 2.50% of final average 1.85% of final average

salary for each year of salary for each year of

credited service. This credited service.

amount cannot be greater

than 75.0% of the final

average salary nor less

than $400 per month.

Service credit used to determine the benefit amount may be increased by credit

granted for unused sick leave (on a percent of possible total basis).

31