Page 7 - BACWA - AED - AMB 01 28 20

P. 7

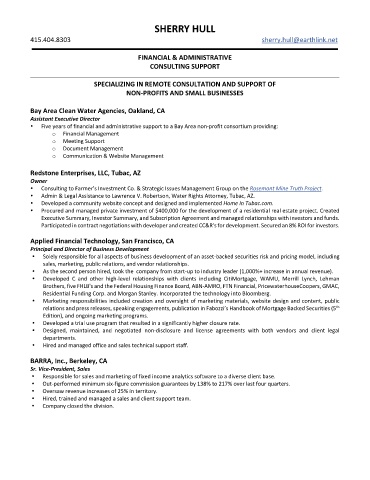

SHERRY HULL

415.404.8303 sherry.hull@earthlink.net

FINANCIAL & ADMINISTRATIVE

CONSULTING SUPPORT

SPECIALIZING IN REMOTE CONSULTATION AND SUPPORT OF

NON‐PROFITS AND SMALL BUSINESSES

Bay Area Clean Water Agencies, Oakland, CA

Assistant Executive Director

Five years of financial and administrative support to a Bay Area non‐profit consortium providing:

o Financial Management

o Meeting Support

o Document Management

o Communication & Website Management

R e d s t o n e E n t e r p r i s e s , L L C , T u b a c , A Z

Owner

Consulting to Farmer’s Investment Co. & Strategic Issues Management Group on the Rosemont Mine Truth Project.

Admin & Legal Assistance to Lawrence V. Robertson, Water Rights Attorney, Tubac, AZ.

Developed a community website concept and designed and implemented Home In Tubac.com.

Procured and managed private investment of $400,000 for the development of a residential real estate project. Created

Executive Summary, Investor Summary, and Subscription Agreement and managed relationships with investors and funds.

Participated in contract negotiations with developer and created CC&R’s for development. Secured an 8% ROI for investors.

A p p l i e d F i n a n c i a l T e c h n o l o g y , S a n F r a n c i s c o , C A

Principal and Director of Business Development

Solely responsible for all aspects of business development of an asset‐backed securities risk and pricing model, including

sales, marketing, public relations, and vendor relationships.

As the second person hired, took the company from start‐up to industry leader (1,000%+ increase in annual revenue).

Developed C and other high‐level relationships with clients including CitiMortgage, WAMU, Merrill Lynch, Lehman

Brothers, five FHLB's and the Federal Housing Finance Board, ABN‐AMRO, FTN Financial, PricewaterhouseCoopers, GMAC,

Residential Funding Corp. and Morgan Stanley. Incorporated the technology into Bloomberg.

Marketing responsibilities included creation and oversight of marketing materials, website design and content, public

th

relations and press releases, speaking engagements, publication in Fabozzi’s Handbook of Mortgage Backed Securities (5

Edition), and ongoing marketing programs.

Developed a trial use program that resulted in a significantly higher closure rate.

Designed, maintained, and negotiated non‐disclosure and license agreements with both vendors and client legal

departments.

Hired and managed office and sales technical support staff.

B A R R A , I n c . , B e r k e l e y , C A

Sr. Vice‐President, Sales

Responsible for sales and marketing of fixed income analytics software to a diverse client base.

Out‐performed minimum six‐figure commission guarantees by 138% to 217% over last four quarters.

Oversaw revenue increases of 25% in territory.

Hired, trained and managed a sales and client support team.

Company closed the division.