Page 25 - Annual Report 2017

P. 25

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Financial Statements

December 31, 2016 and 2015

NOTE C SECURITIES AVAILABLE FOR SALE (CONTINUED)

Management does not have the intent to sell any of the securities classified as available for

sale that are in an unrealized loss position and believes that it is more likely than not that

the Company will not have to sell any of these securities before a recovery of cost. The

unrealized losses are attributable primarily to changes in market interest rates relative to

those available when the securities were acquired. The fair value of these securities is

expected to recover as the securities reach their maturity or re-pricing date, or if changes

in market rates for such investments decline. Management does not believe that any of the

securities are impaired due to reasons of credit quality. Accordingly, as of December 31,

2016 and 2015, management believes the impairments for securities in an unrealized loss

position are temporary and no impairment loss has been realized in the Company’s

consolidated statements of income for the years then ended.

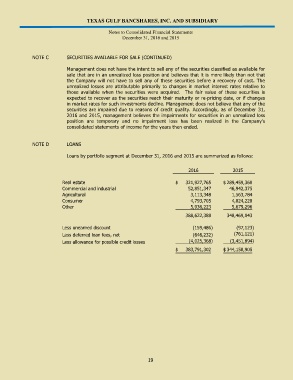

NOTE D LOANS

Loans by portfolio segment at December 31, 2016 and 2015 are summarized as follows:

2016 2015

Real estate $ 321,927,765 $ 289,459,360

Commercial and industrial 52,851,347 46,942,375

Agricultural 3,113,348 1,563,784

Consumer 4,793,705 4,824,228

Other 5,936,223 5,679,296

388,622,388 348,469,043

Less unearned discount (159,486) (97,123)

Less deferred loan fees, net (646,232) (761,121)

Less allowance for possible credit losses (4,025,368) (3,451,894)

$ 383,791,302 $ 344,158,905

19