Page 336 - Aida Hovsepian Onboarding

P. 336

Confidential and Privileged

For the Audit and Finance Committee's Review

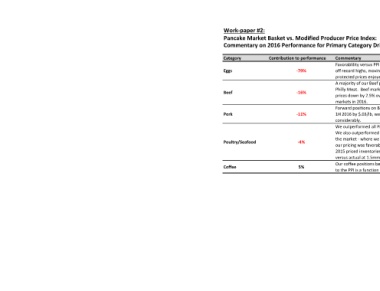

Work-paper #2:

Pancake Market Basket vs. Modified Producer Price Index:

Commentary on 2016 Performance for Primary Category Drivers

Category Contribution to performance Commentary

Favorablility versus PPI in 2015 due to protections against higher markets reversed in 2016 as markets came

Eggs -79% off record highs, moving the PPI down 60% for the category, while our costs were down 21% from those

protected prices enjoyed in 2015.

A majority of our Beef product agreements were fixed price for full year 2016, except for Beef Patties and

Philly Meat. Beef markets were down in 2016, with PPI measures down between 3.7% to 20% versus our

Beef -16%

prices down by 2.5% overall. Our fixed price agreements were unfavorable versus these softening beef

markets in 2016.

Forward positions on Bellies in 2016 were unfavorable to market for FY by approximately 6%. Favorability in

Pork -11% 1H 2016 by $.03/lb, was offset by unfavorability in Q3 of $.03/lb and $.40/lb in Q4 as belly markets softened

considerably.

We outperformed all PPI measures for our Chicken purchases in 2016, outperforming the PPI by 4% in total.

We also outperformed on our single seafood item - Tilapia. Turkey is the single item that underperformed

the market - where we showed a 15% YOY increase in actual cost, versus the PPI showed down 10%. While

Poultry/Seafood -4%

our pricing was favorable to PPI in 2015's higher markets (by 4+%), a decrease in volumes had us carrying

2015 priced inventories through much of 2016 as markets came down. Volume was forecast at 2.2mm lbs,

versus actual at 1.5mm lbs.

Our coffee positions beat the market in 2016 (4% better than "C"), but the remainder of our outperfromance

Coffee 5%

to the PPI is a function of higher than market "C" cost in 2015.