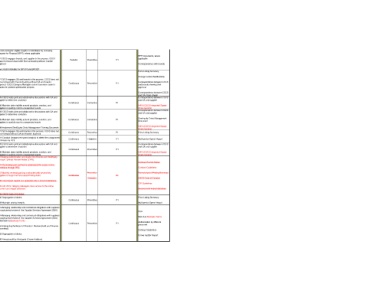

Page 421 - Onboarding May 2017

P. 421

C6-Screening for eligible supplier or distributor by reviewing

Request for Proposal (RFP), where applicable

RFP Documents, where

R1, R2, R4, C7-CSCS engages brands, and supplier in the process. CSCS applicable

(B) Alternate Sourcing - Non-Food Procurement R3-Continuity of supply Periodic Preventive P1

R5, R9 does not move forward with final contracting without brands'

approval Correspondence with brands

See Control Activities for BP 510 and BP 520

Price Listing Summary

Change Control Notifications

C7-CSCS engages QA and brands in the process. CSCS does not

BP 540 & Product Optimization & Specification Alignment Procurement R2-Ineligible product that does not meet CSCS and R4, R5, R9 move forward with final contracting without QA and brands' Continuous Preventive P1 Correspondence between CSCS

550 DineEquity's standards and qualifications approval. CSCS Category Managers submit business cases to and brands showing their

Brands for product optimization projects. approval

Correspondence between CSCS

and QA (Spec Sheet)

C15-CSCS holds joint and collaborative discussions with QA and Correspondence between CSCS

R4-Food Safety

Procurement/ supplier to determine a solution and QA and supplier

Product Recalls and Withdrawals R3, R4, R18-

BP 620 (Mostly QA Process) Brand R9-Damage to brand and company reputation by 1, R23, R24 Continuous Corrective P1

Management

unethical behavior or incompetence C36-Maintain data visibility around products, vendors, and HAVI (CSCS Integrated Supply

suppliers to quickly react to unexpected events Chain System)

Correspondence between CSCS

C15-CSCS holds joint and collaborative discussions with QA and

supplier to determine a solution and QA and supplier

R3-Continuity of supply

Critical Event Management (Storms, Fire, etc.) Procurement/ DineEquity Crisis Management

BP 630 R18-1 C36-Maintain data visibility around products, vendors, and Continuous Corrective P1

Product (Mostly QA Process) Logistics R4-Food Safety suppliers to quickly react to unexpected events Document

Management & HAVI (CSCS Integrated Supply

Enforcement C48-Implement DineEquity Crisis Management Training Document Chain System)

BP 640 Product Substitutions Procurement R4-Food Safety R18-1 C7-CSCS engages QA and brands in the process. CSCS does not Continuous Preventive P1 Price Listing Summary

(Approved Product Purchases) move forward without QA and brands' approval

R4-Food Safety

BP 650 Unapproved Product Purchases Procurement R9 C31-Conduct Unapproved spend analysis to detect the unapproved Continuous Detective P1 Multi-period Spend Report

R18-1-Unfavorable impacts on cost of goods sold purchases by DCs

R3-Continuity of supply C15-CSCS holds joint and collaborative discussions with QA and Correspondence between CSCS

supplier to determine a solution and QA and supplier

Quality Holds on Products at Supplier or DC Procurement/

BP 660 R4-Food Safety R9, R18-1 Continuous Preventive P1

(Mostly QA Process) Logistics

C36-Maintain data visibility around products, vendors, and HAVI (CSCS Integrated Supply

R5-Compromised product quality suppliers to quickly react to unexpected events Chain System)

C8-Seeking authorization and inputs from Brands and DineEquity

R19-Inaccurate information and data through Contract Review Notice (CRN).

Contract Review Notice

R11-Fradulent activities which are subject of public C11-Reviewing each contract to understand the scope, terms,

scrutiny and investigation conditions through PRC Contract Guidelines

Cost Impact Procurement/ R12-Legally unsound contracts heavily biased in C17-Monthly reviewing pricing contracted with several key Preventive Formula-based Pricing Summary

Reporting BP 10 Cost Impact Reporting Administration suppliers’ favor R23 suppliers through Formula-based Pricing Audit Continuous Detective P1 CSCS Code of Conduct

R13-Exploited and manipulated by monopolies, C19-Cost impact reports are uploaded onto a secured database.

cartels and hostile contractors CIR Guidelines

C20-All CSCS Category Managers have access to the online

R14-1-Poorly designed contracts' terms and secured cost impact database. Secured cost impact database

conditions

C29-CSCS Code of Conduct

Price R17-Pricing discrepancy or disadvantage C32-Segregation of duties Price Listing Summary

Maintenance BP 30 Price Maintenance Procurement/ R23 Continuous Preventive P1

Administration

Process R18-1-Unfavorable impacts on cost of goods sold C39-Maintain pricing integrity Multi-period Spend Report

C2-Managing relationship and contractual obligations with suppliers

through period review of the Supplier Services Agreement (SSA)

SSA

C3-Managing relationship and contractual obligations with suppliers SSA-A & Business Terms

through period review of the Supplier Services Agreement (SSA)

Rebate Procurement/ R11-Fradulent activities which are subject of public R9, R18-1, Addendum & Business Terms Authorization by different

Management BP 40 Product Rebates Logistics/ scrutiny and investigation R23 C9-Undergoing the Board of Directors' Review (Audit and Finance Continuous Preventive P1 personnel

Administration

Committee)

Contract Guidelines

C32-Segregation of duties

Crowe Auditor Report

C40-Annual audit by third party (Crowe Auditors)