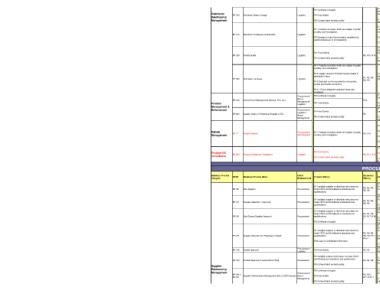

Page 416 - Onboarding May 2017

P. 416

C4-Managing relationship and contractual obligations with

R3-Continuity of supply Distributor Services Agreement

distributors through period review of the Distributor Services

Distributor BP 200 Distributor Status Change Logistics R4-Food Safety Agreement (DSA) & C53-Market Distribution Agreement (MDA) Periodic Preventive P1 QA's Email

Relationship Corrective

Management R5-Compromised product quality C15-CSCS holds joint and collaborative discussions with QA to Market Distribution Agreement

determine a solution

Supplier/ Distributor Funding

C16-Managing relationship and contractual obligation with Questionnaire on brand

R11-Fradulent activities which are subject of public suppliers/distributors through Supplier/ Distributor Funding registration website and Approval

scrutiny and investigation Questionnaire and Approval

BP 210 Distributor Funding & Contributions Logistics Periodic Preventive P1 CSCS Code of Conduct

R9-Damage to brand and company reputation by C29-Follow CSCS Code of Conduct

unethical behavior or incompetence Reconciliation Spreadsheet

C32-Segregation of duties showing committed vs. received

amounts

C4-Managing relationship and contractual obligations with

distributors through period review of the Distributor Services

R4- Food Safety Agreement (DSA) & C53-Market Distribution Agreement (MDA). Preventive Distributor Services Agreement

BP 230 Facility Audits Logistics R9, R15, R16 Periodic P1

R5-Compromised product quality C15-CSCS holds joint and collaborative discussions with QA to Corrective QA's Audit Database

determine a solution

R11-Fradulent activities which are subject of public

scrutiny and investigation

R12-Legally unsound contracts heavily biased in C4-Managing relationship and contractual obligations with

distributor’s favor distributors through period review of the Distributor Services

BP 520 Distributor Contracts Logistics R1, R2, R4, Agreement (DSA) and C53-Market Distribution Agreement (MDA). Periodic Preventive P1 Distributor Services Agreement

R5, R9

R13-Exploited and manipulated by monopolies,

cartels and hostile contractors

R14-1-Poorly designed contracts' terms and

conditions

Procurement/ R3-Continuity of supply C15-DineEquity's risk management function initiates conversations Periodic P1 Correspondence between CSCS

and QA and supplier

between parties to determine a solution.

Brand

BP 630 Critical Event Management (Storms, Fire, etc.) R18 Corrective

Product Management/ R4-Food Safety C36-Maintain data visibility around products, vendors, and Continuous P1 HAVI (CSCS Integrated Supply

Logistics

Management & suppliers to quickly react to unexpected events Chain System)

Enforcement Procurement/ R4-Food Safety C15-CSCS holds joint and collaborative discussions with QA and Email correspondence between

supplier to determine a solution

CSCS and QA

Logistics /

BP 660 Quality Holds on Products at Supplier or DC R9 Periodic Preventive P1

Brand R5-Compromised product quality C36-Maintain data visibility around products, vendors, and HAVI (CSCS Integrated Supply

Management

suppliers to quickly react to unexpected events Chain System)

Authorization by different

personnel

C32-Segregation of duties

Contract Guidelines

Rebate Procurement/ R11-Fradulent activities which are subject of public C29-Follow CSCS Code of Conduct

Management BP 47 Freight Rebates Administration scrutiny and investigation R9, R18 Continuous Preventive P1 CSCS Code of Conduct

C54-Executed Freight Agreements

C55-Volume Report from Distributor Executed Freight Agreements

Volume Report from Distributor

C32-Segregation of duties

Produce DC R4-Food Safety C54-Executed Produce Distribution Agreements Executed Produce Distribution

Agreement

Compliance BP 690 Produce Distributor Compliance Logistics R5-Compromised product quality R9, R11, R18 Continuous Preventive P1

C55-Volume Report from Distributor and Danaco (Third-party DC Volume Report (Danaco)

Produce Solution)

PROCUREMENT

Control Characteristics

Business Process BP ID Business Process Name CSCS Primary Risk (s) Secondary CONTROL ACTIVITY (IES) Control Frequency Control Primary 1 (P1 - Critical Control), EVIDENCE OF CONTROL

Category Business Unit Risk (s) (continuous, daily, Nature Primary 2 (P2 - Significant Control),

monthly, periodic) Secondary (S)

C1-Managing relationship and contractual obligations with Review of Mutual Confidentiality

R1-Ineligible supplier or distributor who does not DineEquity and Brand through periodic review of Mutual Agreement / Rules of

BP100 New Supplier Procurement meet CSCS and DineEquity's standards and R2, R3, R4, Confidentiality Agreement / Rules of Engagement (MCA/ROE) Periodic Preventive P2 Engagement (MCA/ROE)

R5, R9

qualifications Havi Registration

C29-Follow CSCS Code of Conduct CSCS Code of Conduct

C6-Selecting eligible supplier based on reviewing responses from Havi

R1-Ineligible supplier or distributor who does not Request for Proposal (RFP) process, if applicable

BP110 Supplier Selection / Approval Procurement meet CSCS and DineEquity's standards and R2, R3, R4, Periodic Preventive P1 Emails between CSCS and QA

R5, R9

qualifications C7-CSCS engages QA in the selection process. CSCS does not

move forward with final contracting without QA approval Facility Approval

R1-Ineligible supplier or distributor who does not C6-Selecting eligible supplier based on reviewing responses from Brand notifications

Request for Proposal (RFP) process, if applicable

meet CSCS and DineEquity's standards and R2, R4, R5,

BP120 Sole Source Supplier Approval Procurement qualifications R9, R17, R18- C7-CSCS engages brands and QA in this process. CSCS does not Periodic Preventive P1 Review with the Board evident in

Board Material

1

R3-Continuity of supply move forward with final contracting without QA and brands'

approval. Category managers submit business cases to brands. Cost savings database & ideas

C1-Managing relationship and contractual obligations with

DineEquity and Brand through periodic review of Mutual

R1-Ineligible supplier or distributor who does not Confidentiality Agreement / Rules of Engagement (MCA/ROE) Review of Mutual Confidentiality

meet CSCS and DineEquity's standards and R2, R3, R4, Agreement / Rules of

BP125 Supplier Selection for Proprietary Product Procurement qualifications R5, R9, R17, C6-Selecting eligible supplier based on reviewing responses from Periodic Preventive P1 Engagement (MCA/ROE)

R18-1 Request for Proposal (RFP) process, where applicable

R22-Leak of Confidential Information Brand notifications

C7-CSCS engages brands in the process. CSCS does not move

forward with final contracting without brands' approval

BP 140 Facility Approval Procurement / R4-Food Safety R3, R5 C7-CSCS engages QA in this process. CSCS does not move Periodic Preventive P1 Correspondence between CSCS

Logistics forward with final contracting without QA approval and QA showing QA's approval

Correspondence between CSCS

R2-Ineligible product which does not meet CSCS C7-CSCS engages QA, brands, and supplier in the process. CSCS and QA showing QA's approval

and DineEquity's standards and qualifications (For Food only)

BP 150 Product Approval (Food and Non-food) Procurement R3, R4, R9 does not move forward with final contracting without QA and Periodic Preventive P1

Supplier R5-Compromised product quality brands' approval Approved Supplier and Product

List by QA (For Food only)

Relationship

Management Procurement/ R3-Continuity of supply C13-Monitoring key, high-risk, and high-value inventory through Brand Emails

Authorization for Inventory Purchase, where applicable

BP160 & Supplier Performance Management (DE or CSCS Issues) Brand R4-Food Safety R2, R15, Continuous Preventive S

BP170 R17, R18-1 PRC Program Summary, if

Management C15-CSCS holds joint and collaborative discussions with QA and applicable

R5-Compromised product quality supplier to determine a solution through Alternate Sourcing Process