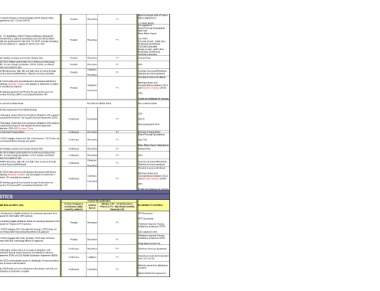

Page 415 - Onboarding May 2017

P. 415

Menu/Campaign brief & Product

Brand C51-Brand prepares a menu/campaign brief & product matrix Matrix (Applebee's)

BP 370 Promotion Initiation R3-Continuity of supply R9 Periodic Preventive P1

Management (Applebee's) and LTO brief (IHOP)

LTO Brief (IHOP)

For Applebee's:

Brand Forecast Spreadsheet

Star Chef

Menu Maker Report

C52- For Applebee's, Brand Finance publishes a forecast for

Brand promotion/menu, optional and deletes come from Menu Maker. For IHOP:

BP 380 Promotion Forecasting Including Yields R19-Incorrect information and data R9 Periodic Preventive P1

Management Yields are warehoused in Star Chef. For IHOP, forecast (including Forecast (email) - public drive.

yield assumptions) is supplied by Brand via E-mail. W:\Shared Dine\Shared

Promotion / LTO CSCS\ALL\Glendale

/ Product Recipe (email) - public drive.

Features W:\Shared Dine\Shared

CSCS\ALL\Glendale

Brand

BP 390 Promotion Demand Planning R3-Continuity of supply R9 C34-Carefully construct and review Demand Plan. Periodic Preventive P1 Demand Plan

Management

(AIP). In order to begin production, CSCS, brands, and Board

BP 400 Promotion Execution & Management Brand R3-Continuity of supply R9 C18-CSCS initiates authorization for inventory purchase policy Periodic Preventive P1 AIPs

Management

Chairs must agree to sign

Detective

Brand R3-Continuity of supply R18, R23, C13-Monitoring key, high-risk, and high-value inventory through Inventory Scorecard/Workbook,

BP 410 Promotion Inventory Management Periodic P1

Management R15-Obsolete Inventory R24 Inventory Scorecard/Workbook, Obsolete Inventory workbook Obsolete Inventory workbook

Preventive

Obsolete Inventory Workbook

C15-CSCS holds joint and collaborative discussions with Brand Meeting minutes and

Marketing, Business Analytics and supplier to determine a solution.

Brand QA consulted as required. Detective correspondence between CSCS

BP 420 Promotion Obsolete Inventory Resolution R18-1-Unfavorable impacts on cost of goods sold R23, R24 Periodic P1 and Business Analytics (IHOP)

Management Corrective

C18-Seeking approval from Brands through Authorization for AIPs

Inventory Purchase (AIP) if exceeding threshold in AIP.

Emails and database for invoices

See relevant risks below: menu demand planning,

Brand

BP 430 Menu Implementation Overview menu execution & management, and menu See relevant controls below See relevant details below See evidence below

Management inventory management

C12-Risk Assessment Form (Both Brands)

SSA

C2-Managing relationship and contractual obligations with suppliers

Brand through period review of the Supplier Services Agreement (SSA)

BP 440 Menu Planning R3-Continuity of supply R9 Continuous Preventive P1 SSA-A

Management

C3-Managing relationship and contractual obligations with suppliers Risk Assessment Form

through period review of the Supplier Services Agreement

Addendum (SSA-A) & Business Terms

BP 450 Menu Initiation Procurement R3-Continuity of supply R9 C51-Brief and Product Matrix Continuous Preventive P1 Brief and Product Matrix

Brand Forecast Spreadsheet

Brand C7-CSCS engages brands and QA in this process. CSCS does not

BP 460 Menu Forecasting Including Yields R19-Incorrect information and data R9, R18 Continuous Preventive P1 Star Chef

Management move forward without forecast and yields

Menu Menu Maker Report (Applebee's)

Brand

BP 470 Menu Demand Planning R3-Continuity of supply R9, R18 C34-Carefully construct and review Demand Plan Continuous Preventive P1 Demand Plan

Management

C18-CSCS initiates authorization for inventory purchase policy

BP 480 Menu Execution & Management Brand R3-Continuity of supply R9, R18 (AIP). In order to begin production, CSCS, brands, and Board Continuous Preventive P1 AIPs

Management

Chairs must agree to sign

Detective

Brand R3-Continuity of supply R18, R23, C13-Monitoring key, high-risk, and high-value inventory through Inventory Scorecard/Workbook,

BP 490 Menu Inventory Management Continuous P1

Management R15-Obsolete Inventory R24 Inventory Scorecard/Workbook Obsolete Inventory workbook

Preventive

Obsolete Inventory Workbook

C15-CSCS holds joint and collaborative discussions with Brand Meeting minutes and

Marketing, Business Analytics, QA and supplier to determine a

Menu Obsolete Inventory and Incremental Expense Brand solution. QA consulted as required. Detective correspondence between CSCS

BP 500 R18-1-Unfavorable impacts on cost of goods sold R23, R24 Continuous P1 and Business Analytics (IHOP)

Resolution Management Corrective

C18-Seeking approval from Brands through Authorization for AIPs

Inventory Purchase (AIP) if exceeding threshold in AIP.

Emails and database for invoices

LOGISTICS

Control Characteristics

Business Process BP ID Business Process Name CSCS Primary Risk (s) Secondary CONTROL ACTIVITY (IES) Control Frequency Control Primary 1 (P1 - Critical Control), EVIDENCE OF CONTROL

Category Business Unit Risk (s) (continuous, daily, Nature Primary 2 (P2 - Significant Control),

monthly, periodic) Secondary (S)

R1-Ineligible supplier or distributor who does not C5-Screening for eligible distributor by reviewing responses from RFI Documents

meet CSCS and DineEquity's standards and Request for Information (RFI) process

qualifications RFP Documents

C6-Selecting eligible distributor based on reviewing responses from

BP130 Distributor Selection / Approval Logistics R3-Continuity of Supply R9 Periodic Preventive P1

Request for Proposal (RFP) process Distributor Approval Process

Guidelines (enclosed in RFP)

R4-Food Safety

C7-CSCS engages QA in the selection process. CSCS does not

move forward with final contracting without QA approval QA's Approval Letter

R5-Compromised product quality

Distributor Approval Process

C7-CSCS engages QA in this process. CSCS does not move Guidelines (enclosed in RFP)

BP 140 Facility Approval Logistics R4-Food Safety R3, R5 Periodic Preventive P1

forward with final contracting without QA approval

Email Approval from QA

R3-Continuity of supply Continuous Preventive P1 Distributor Services Agreement

C4-Managing relationship and contractual obligations with

distributors through period review of the Distributor Services

Agreement (DSA) and C53-Market Distribution Agreement (MDA). Reports of issues and resolutions

R4-Food Safety Continuous Detective P1 from CSCS to QA

BP 180 Distributor Performance Management Logistics R15, R16, C14-CSCS communicates issues to DineEquity QA and provides a

R17, R18

report of issues and resolution

Monthly reports from distributors

R5-Compromised product quality C15-CSCS holds joint and collaborative discussions with QA and Continuous Corrective P1 to CSCS

distributors to determine a solution

Market Distribution Agreement