Page 3 - Module 6 Costly mistakes

P. 3

Module 6 – How to avoid costly trading mistakes

1. money management in a nutshell

Ask 100 traders what Money management means to them, and one will get 100 different answers.

However, all 100 of them will confirm that financial survival is pre-eminent. To survive financially in

this market, you will need to learn how to manage your money, and never, never over trade your

margin account!

Money management means exactly what it says. It’s the management of your Money or the money

in your margin account that you are trading.

Everyone in some form or another practices money management in day-to-day life, whether in their

personal capacities or with investment management such as trading. Trading Forex and CFD’s

successfully does require discipline. You’ll need a proper knowledge of the basic elements that are

vital if you are expecting long-term gains from this industry.

Inexperience is by far the main reason for traders losing money in Forex and CFD’s trading.

Neglecting risk management principles increases risk and decreases your reward. Forex and CFD

trading is extremely volatile at the best of times with inherent risk. The proper application of money

management gives a Forex Trader an account growth edge, while trading Forex without a logical

money management strategy typically amounts to little more than gambling.

Accordingly, proper risk and money management techniques need to be understood and

consistently practiced by any forex trader who wants to grow their trading account and remain in

the currency trading business over a long term.

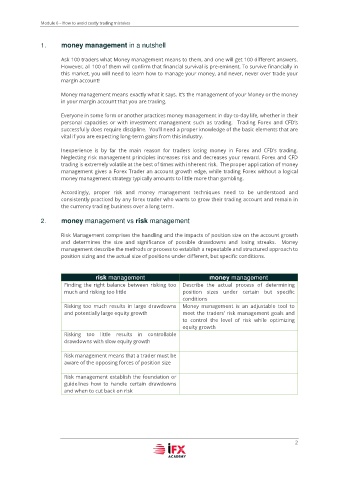

2. money management vs risk management

Risk Management comprises the handling and the impacts of position size on the account growth

and determines the size and significance of possible drawdowns and losing streaks. Money

management describe the methods or process to establish a repeatable and structured approach to

position sizing and the actual size of positions under different, but specific conditions.

risk management money management

Finding the right balance between risking too Describe the actual process of determining

much and risking too little position sizes under certain but specific

conditions

Risking too much results in large drawdowns Money management is an adjustable tool to

and potentially large equity growth meet the traders’ risk management goals and

to control the level of risk while optimizing

equity growth

Risking too little results in controllable

drawdowns with slow equity growth

Risk management means that a trader must be

aware of the opposing forces of position size

Risk management establish the foundation or

guidelines how to handle certain drawdowns

and when to cut back on risk

2