Page 8 - Module 6 Costly mistakes

P. 8

Module 6 – How to avoid costly trading mistakes

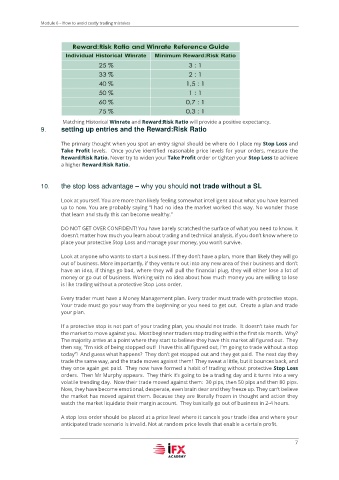

Matching Historical Winrate and Reward:Risk Ratio will provide a positive expectancy.

9. setting up entries and the Reward:Risk Ratio

The primary thought when you spot an entry signal should be where do I place my Stop Loss and

Take Profit levels. Once you’ve identified reasonable price levels for your orders, measure the

Reward:Risk Ratio. Never try to widen your Take Profit order or tighten your Stop Loss to achieve

a higher Reward:Risk Ratio.

10. the stop loss advantage – why you should not trade without a SL

Look at yourself. You are more than likely feeling somewhat intelligent about what you have learned

up to now. You are probably saying “I had no idea the market worked this way. No wonder those

that learn and study this can become wealthy.”

DO NOT GET OVER CONFIDENT! You have barely scratched the surface of what you need to know. It

doesn’t matter how much you learn about trading and technical analysis, if you don’t know where to

place your protective Stop Loss and manage your money, you won’t survive.

Look at anyone who wants to start a business. If they don’t have a plan, more than likely they will go

out of business. More importantly, if they venture out into any new area of their business and don’t

have an idea, if things go bad, where they will pull the financial plug, they will either lose a lot of

money or go out of business. Working with no idea about how much money you are willing to lose

is like trading without a protective Stop Loss order.

Every trader must have a Money Management plan. Every trader must trade with protective stops.

Your trade must go your way from the beginning or you need to get out. Create a plan and trade

your plan.

If a protective stop is not part of your trading plan, you should not trade. It doesn’t take much for

the market to move against you. Most beginner traders stop trading within the first six month. Why?

The majority arrive at a point where they start to believe they have this market all figured out. They

then say, “I’m sick of being stopped out! I have this all figured out, I’m going to trade without a stop

today”! And guess what happens? They don’t get stopped out and they get paid. The next day they

trade the same way, and the trade moves against them! They sweat a little, but it bounces back, and

they once again get paid. They now have formed a habit of trading without protective Stop Loss

orders. Then Mr Murphy appears. They think it’s going to be a trading day and it turns into a very

volatile trending day. Now their trade moved against them: 30 pips, then 50 pips and then 80 pips.

Now, they have become emotional, desperate, even brain dear and they freeze up. They can’t believe

the market has moved against them. Because they are literally frozen in thought and action they

watch the market liquidate their margin account. They basically go out of business in 2-4 hours.

A stop loss order should be placed at a price level where it cancels your trade idea and where your

anticipated trade scenario is invalid. Not at random price levels that enable a certain profit.

7