Page 5 - Module 15 - Trending or Trading

P. 5

Module 15 – Trending or Trading

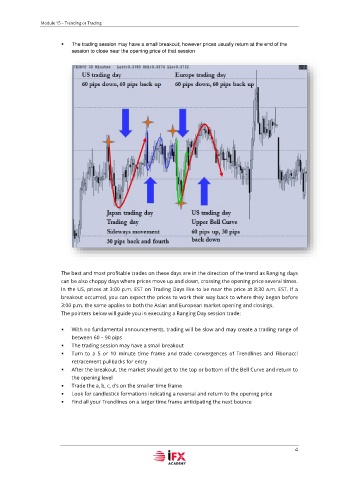

▪ The trading session may have a small breakout; however prices usually return at the end of the

session to close near the opening price of that session

The best and most profitable trades on these days are in the direction of the trend as Ranging days

can be also choppy days where prices move up and down, crossing the opening price several times.

In the US, prices at 3:00 p.m. EST on Trading Days like to be near the price at 8:30 a.m. EST. if a

breakout occurred, you can expect the prices to work their way back to where they began before

3:00 p.m. the same applies to both the Asian and European market opening and closings.

The pointers below will guide you in executing a Ranging Day session trade:

▪ With no fundamental announcements, trading will be slow and may create a trading range of

between 60 – 90 pips

▪ The trading session may have a small breakout

▪ Turn to a 5 or 10 minute time frame and trade convergences of Trendlines and Fibonacci

retracement pullbacks for entry

▪ After the breakout, the market should get to the top or bottom of the Bell Curve and return to

the opening level

▪ Trade the a, b, c, d’s on the smaller time frame

▪ Look for candlestick formations indicating a reversal and return to the opening price

▪ Find all your Trendlines on a larger time frame anticipating the next bounce

4