Page 7 - Module 15 - Trending or Trading

P. 7

Module 15 – Trending or Trading

Trade WITH the trend instead of AGAINST the trend. A trend is your friend until it bends. As a rule in

trading currencies if prices have increased or decreased by 120 pips or more for the day, the

percentages are real low that the prices will retrace back to the 8:30 a.m. EST or where the day

started. In other words, don’t expect the price to come back to the 8:30 a.m. EST price by the end of

the day. It is not the rule, just a high percentage. If you trade with the trend you can expect to capture

a fair number of pips especially if you use a cancel and replace strategy.

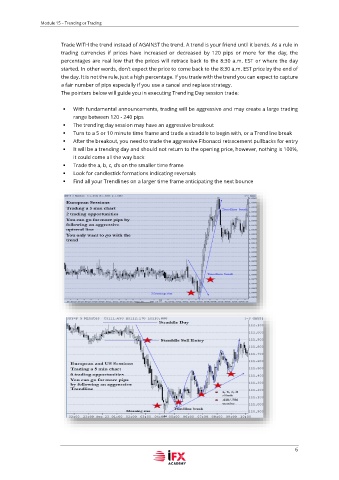

The pointers below will guide you in executing Trending Day session trade:

▪ With fundamental announcements, trading will be aggressive and may create a large trading

range between 120 - 240 pips

▪ The trending day session may have an aggressive breakout

▪ Turn to a 5 or 10 minute time frame and trade a straddle to begin with, or a Trendline break

▪ After the breakout, you need to trade the aggressive Fibonacci retracement pullbacks for entry

▪ It will be a trending day and should not return to the opening price, however, nothing is 100%,

it could come all the way back

▪ Trade the a, b, c, d’s on the smaller time frame

▪ Look for candlestick formations indicating reversals

▪ Find all your Trendlines on a larger time frame anticipating the next bounce

6