Page 15 - bneIntelliNews Small Stans & Mongolia Outlook 2025

P. 15

“Domestic demand was a key driver of growth [in 2024], but is putting pressure on the balance of payments as imports outpace revenues from commodity exports,” said the World Bank in December.

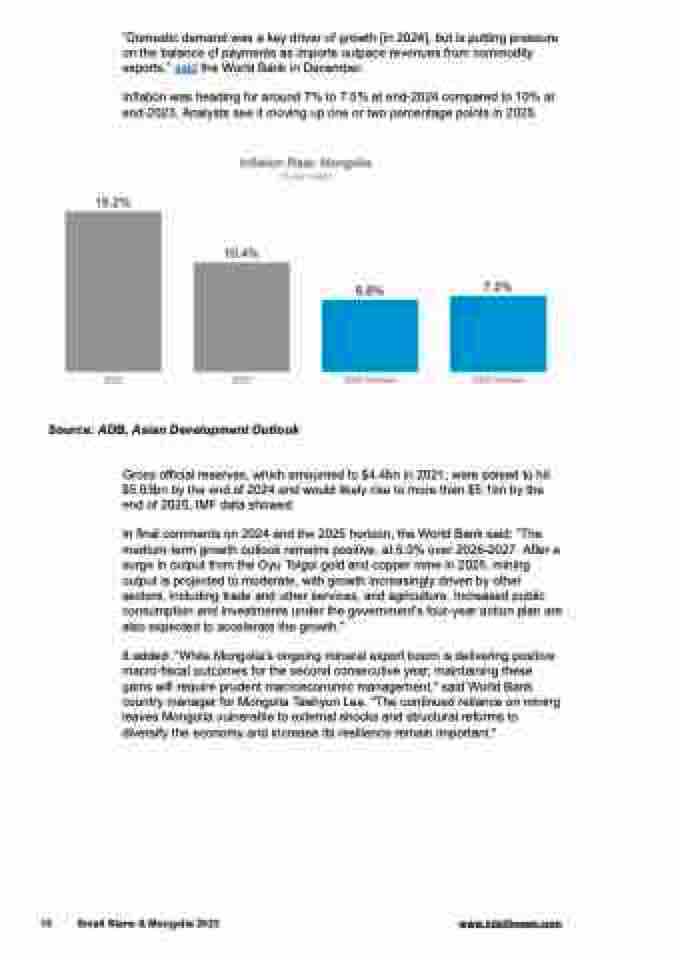

Inflation was heading for around 7% to 7.5% at end-2024 compared to 10% at end-2023. Analysts see it moving up one or two percentage points in 2025.

Source: ADB, Asian Development Outlook

Gross official reserves, which amounted to $4.4bn in 2021, were poised to hit $5.03bn by the end of 2024 and would likely rise to more than $5.1bn by the end of 2025, IMF data showed.

In final comments on 2024 and the 2025 horizon, the World Bank said: “The medium-term growth outlook remains positive, at 6.0% over 2026-2027. After a surge in output from the Oyu Tolgoi gold and copper mine in 2025, mining output is projected to moderate, with growth increasingly driven by other sectors, including trade and other services, and agriculture. Increased public consumption and investments under the government’s four-year action plan are also expected to accelerate the growth.”

It added: "While Mongolia's ongoing mineral export boom is delivering positive macro-fiscal outcomes for the second consecutive year, maintaining these gains will require prudent macroeconomic management," said World Bank country manager for Mongolia Taehyun Lee. "The continued reliance on mining leaves Mongolia vulnerable to external shocks and structural reforms to diversify the economy and increase its resilience remain important."

15 Small Stans & Mongolia 2023 www.intellinews.com