Page 67 - SE Outlook Regions 2023

P. 67

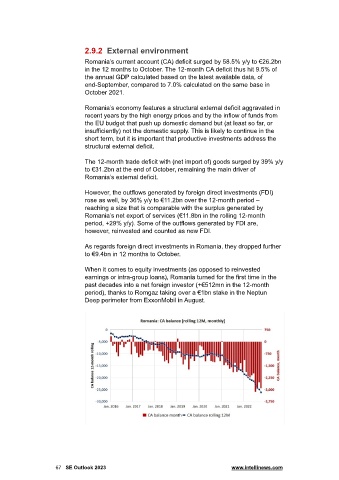

2.9.2 External environment

Romania’s current account (CA) deficit surged by 58.5% y/y to €26.2bn

in the 12 months to October. The 12-month CA deficit thus hit 9.5% of

the annual GDP calculated based on the latest available data, of

end-September, compared to 7.0% calculated on the same base in

October 2021.

Romania’s economy features a structural external deficit aggravated in

recent years by the high energy prices and by the inflow of funds from

the EU budget that push up domestic demand but (at least so far, or

insufficiently) not the domestic supply. This is likely to continue in the

short term, but it is important that productive investments address the

structural external deficit.

The 12-month trade deficit with (net import of) goods surged by 39% y/y

to €31.2bn at the end of October, remaining the main driver of

Romania’s external deficit.

However, the outflows generated by foreign direct investments (FDI)

rose as well, by 36% y/y to €11.2bn over the 12-month period –

reaching a size that is comparable with the surplus generated by

Romania’s net export of services (€11.8bn in the rolling 12-month

period, +29% y/y). Some of the outflows generated by FDI are,

however, reinvested and counted as new FDI.

As regards foreign direct investments in Romania, they dropped further

to €9.4bn in 12 months to October.

When it comes to equity investments (as opposed to reinvested

earnings or intra-group loans), Romania turned for the first time in the

past decades into a net foreign investor (+€512mn in the 12-month

period), thanks to Romgaz taking over a €1bn stake in the Neptun

Deep perimeter from ExxonMobil in August.

67 SE Outlook 2023 www.intellinews.com