Page 68 - SE Outlook Regions 2023

P. 68

2.9.3 Inflation and monetary policy

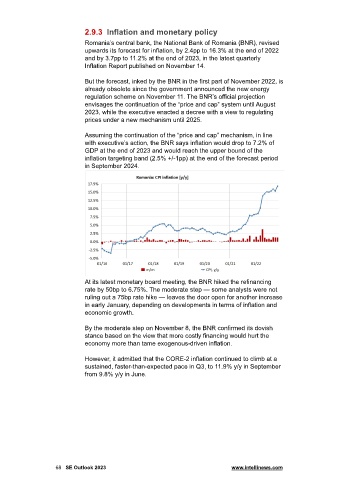

Romania’s central bank, the National Bank of Romania (BNR), revised

upwards its forecast for inflation, by 2.4pp to 16.3% at the end of 2022

and by 3.7pp to 11.2% at the end of 2023, in the latest quarterly

Inflation Report published on November 14.

But the forecast, inked by the BNR in the first part of November 2022, is

already obsolete since the government announced the new energy

regulation scheme on November 11. The BNR’s official projection

envisages the continuation of the “price and cap” system until August

2023, while the executive enacted a decree with a view to regulating

prices under a new mechanism until 2025.

Assuming the continuation of the “price and cap” mechanism, in line

with executive’s action, the BNR says inflation would drop to 7.2% of

GDP at the end of 2023 and would reach the upper bound of the

inflation targeting band (2.5% +/-1pp) at the end of the forecast period

in September 2024.

At its latest monetary board meeting, the BNR hiked the refinancing

rate by 50bp to 6.75%. The moderate step — some analysts were not

ruling out a 75bp rate hike — leaves the door open for another increase

in early January, depending on developments in terms of inflation and

economic growth.

By the moderate step on November 8, the BNR confirmed its dovish

stance based on the view that more costly financing would hurt the

economy more than tame exogenous-driven inflation.

However, it admitted that the CORE-2 inflation continued to climb at a

sustained, faster-than-expected pace in Q3, to 11.9% y/y in September

from 9.8% y/y in June.

68 SE Outlook 2023 www.intellinews.com