Page 10 - DMEA Week 09 2021

P. 10

DMEA PIPELINES DMEA

SNH reportedly seeking to buy

Chad’s stake in oil pipeline

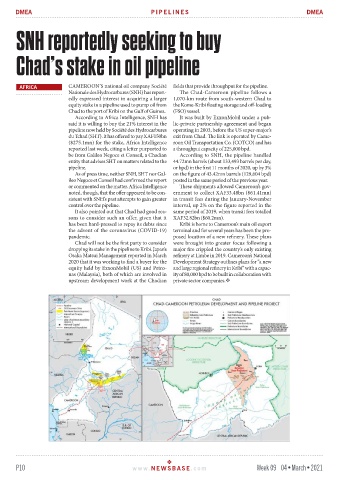

AFRICA CAMEROON’S national oil company Société fields that provide throughput for the pipeline.

Nationale des Hydrocarbures (SNH) has report- The Chad-Cameroon pipeline follows a

edly expressed interest in acquiring a larger 1,070-km route from south-western Chad to

equity stake in a pipeline used to pump oil from the Kome-Kribi floating storage and off-loading

Chad to the port of Kribi on the Gulf of Guinea. (FSO) vessel.

According to Africa Intelligence, SNH has It was built by ExxonMobil under a pub-

said it is willing to buy the 21% interest in the lic-private partnership agreement and began

pipeline now held by Société des Hydrocarbures operating in 2003, before the US super-major’s

du Tchad (SHT). It has offered to pay XAF150bn exit from Chad. The link is operated by Came-

($275.1mn) for the stake, Africa Intelligence roon Oil Transportation Co. (COTCO) and has

reported last week, citing a letter purported to a throughput capacity of 225,000 bpd.

be from Galileo Negoce et Conseil, a Chadian According to SNH, the pipeline handled

entity that advises SHT on matters related to the 44.72mn barrels (about 133,493 barrels per day,

pipeline. or bpd) in the first 11 months of 2020, up by 3%

As of press time, neither SNH, SHT nor Gal- on the figure of 43.42mn barrels (129,604 bpd)

ileo Negoce et Conseil had confirmed the report posted in the same period of the previous year.

or commented on the matter. Africa Intelligence These shipments allowed Cameroon’s gov-

noted, though, that the offer appeared to be con- ernment to collect XAF33.48bn ($61.41mn)

sistent with SNH’s past attempts to gain greater in transit fees during the January-November

control over the pipeline. interval, up 2% on the figure reported in the

It also pointed out that Chad had good rea- same period of 2019, when transit fees totalled

sons to consider such an offer, given that it XAF32.82bn ($60.2mn).

has been hard-pressed to repay its debts since Kribi is home to Cameroon’s main oil export

the advent of the coronavirus (COVID-19) terminal and for several years has been the pro-

pandemic. posed location of a new refinery. These plans

Chad will not be the first party to consider were brought into greater focus following a

dropping its stake in the pipeline to Kribi. Japan’s major fire crippled the country’s only existing

Osaka Matsui Management reported in March refinery at Limbe in 2019. Cameroon’s National

2020 that it was working to find a buyer for the Development Strategy outlines plans for “a new

equity held by ExxonMobil (US) and Petro- and large regional refinery in Kribi” with a capac-

nas (Malaysia), both of which are involved in ity of 80,000 bpd to be built in collaboration with

upstream development work at the Chadian private sector companies.

P10 www. NEWSBASE .com Week 09 04•March•2021