Page 14 - Small Stans Outlook 2024

P. 14

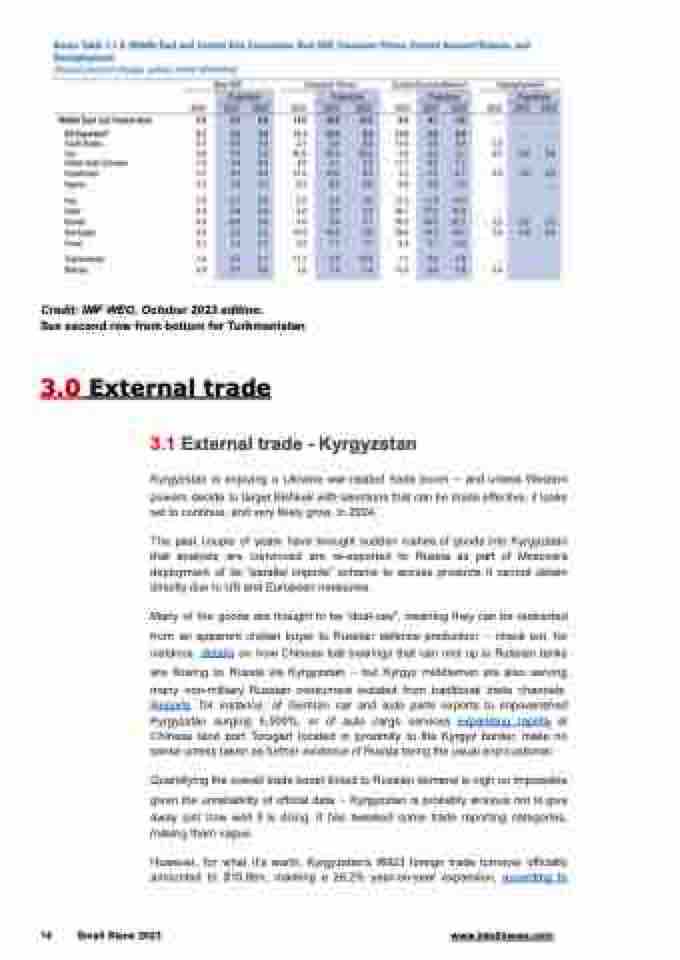

Credit: IMF WEO, October 2023 edition.

See second row from bottom for Turkmenistan

3.0 External trade

3.1 External trade - Kyrgyzstan

Kyrgyzstan is enjoying a Ukraine war-related trade boom – and unless Western

powers decide to target Bishkek with sanctions that can be made effective, it looks set to continue, and very likely grow, in 2024.

The past couple of years have brought sudden rushes of goods into Kyrgyzstan that analysts are convinced are re-exported to Russia as part of Moscow’s deployment of its “parallel imports” scheme to access products it cannot obtain directly due to US and European measures.

Many of the goods are thought to be “dual-use”, meaning they can be redirected from an apparent civilian buyer to Russian defence production – check out, for instance, details on how Chinese ball bearings that can end up in Russian tanks are flowing to Russia via Kyrgyzstan – but Kyrgyz middlemen are also serving many non-military Russian consumers isolated from traditional trade channels. Reports, for instance, of German car and auto parts exports to impoverished Kyrgyzstan surging 5,500%, or of auto cargo services expanding rapidly at Chinese land port Torugart located in proximity to the Kyrgyz border, make no sense unless taken as further evidence of Russia being the usual end-customer.

Quantifying the overall trade boost linked to Russian demand is nigh on impossible given the unreliability of official data – Kyrgyzstan is probably anxious not to give away just how well it is doing. It has tweaked some trade reporting categories, making them vague.

However, for what it’s worth, Kyrgyzstan's 9M23 foreign trade turnover officially amounted to $10.8bn, marking a 26.2% year-on-year expansion, according to

14 Small Stans 2023 www.intellinews.com