Page 14 - DMEA Week 48 2020

P. 14

DMEA LNG DMEA

Exxon, Total in talks over Mozambique

resource-sharing deal

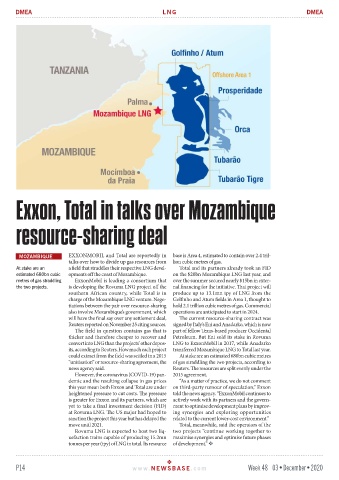

MOZAMBIQUE EXXONMOBIL and Total are reportedly in base is Area 4, estimated to contain over 2.4 tril-

talks over how to divide up gas resources from lion cubic metres of gas.

At stake are an a field that straddles their respective LNG devel- Total and its partners already took an FID

estimated 680bn cubic opments off the coast of Mozambique. on the $20bn Mozambique LNG last year, and

metres of gas straddling ExxonMobil is leading a consortium that over the summer secured nearly $15bn in exter-

the two projects. is developing the Rovuma LNG project off the nal financing for the initiative. That project will

southern African country, while Total is in produce up to 13.1mn tpy of LNG from the

charge of the Mozambique LNG venture. Nego- Golfinho and Atum fields in Area 1, thought to

tiations between the pair over resource-sharing hold 2.1 trillion cubic metres of gas. Commercial

also involve Mozambique’s government, which operations are anticipated to start in 2024.

will have the final say over any settlement deal, The current resource-sharing contract was

Reuters reported on November 25 citing sources. signed by Italy’s Eni and Anadarko, which is now

The field in question contains gas that is part of fellow Texas-based producer Occidental

thicker and therefore cheaper to recover and Petroleum. But Eni sold its stake in Rovuma

convert into LNG than the projects’ other depos- LNG to ExxonMobil in 2017, while Anadarko

its, according to Reuters. How much each project transferred Mozambique LNG to Total last year.

could extract from the field was settled in a 2015 At stake are an estimated 680bn cubic metres

“unitisation” or resource-sharing agreement, the of gas straddling the two projects, according to

news agency said. Reuters. The resources are split evenly under the

However, the coronavirus (COVID-19) pan- 2015 agreement.

demic and the resulting collapse in gas prices “As a matter of practice, we do not comment

this year mean both Exxon and Total are under on third-party rumour of speculation,” Exxon

heightened pressure to cut costs. The pressure told the news agency. “ExxonMobil continues to

is greater for Exxon and its partners, which are actively work with its partners and the govern-

yet to take a final investment decision (FID) ment to optimise development plans by improv-

at Rovuma LNG. The US major had hoped to ing synergies and exploring opportunities

sanction the project this year but has delayed the related to the current lower-cost environment.”

move until 2021. Total, meanwhile, said the operators of the

Rovuma LNG is expected to host two liq- two projects “continue working together to

uefaction trains capable of producing 15.2mn maximise synergies and optimise future phases

tonnes per year (tpy) of LNG in total. Its resource of development.”

P14 www. NEWSBASE .com Week 48 03•December•2020